Starlight Perspectives: Dividend Growth Investing

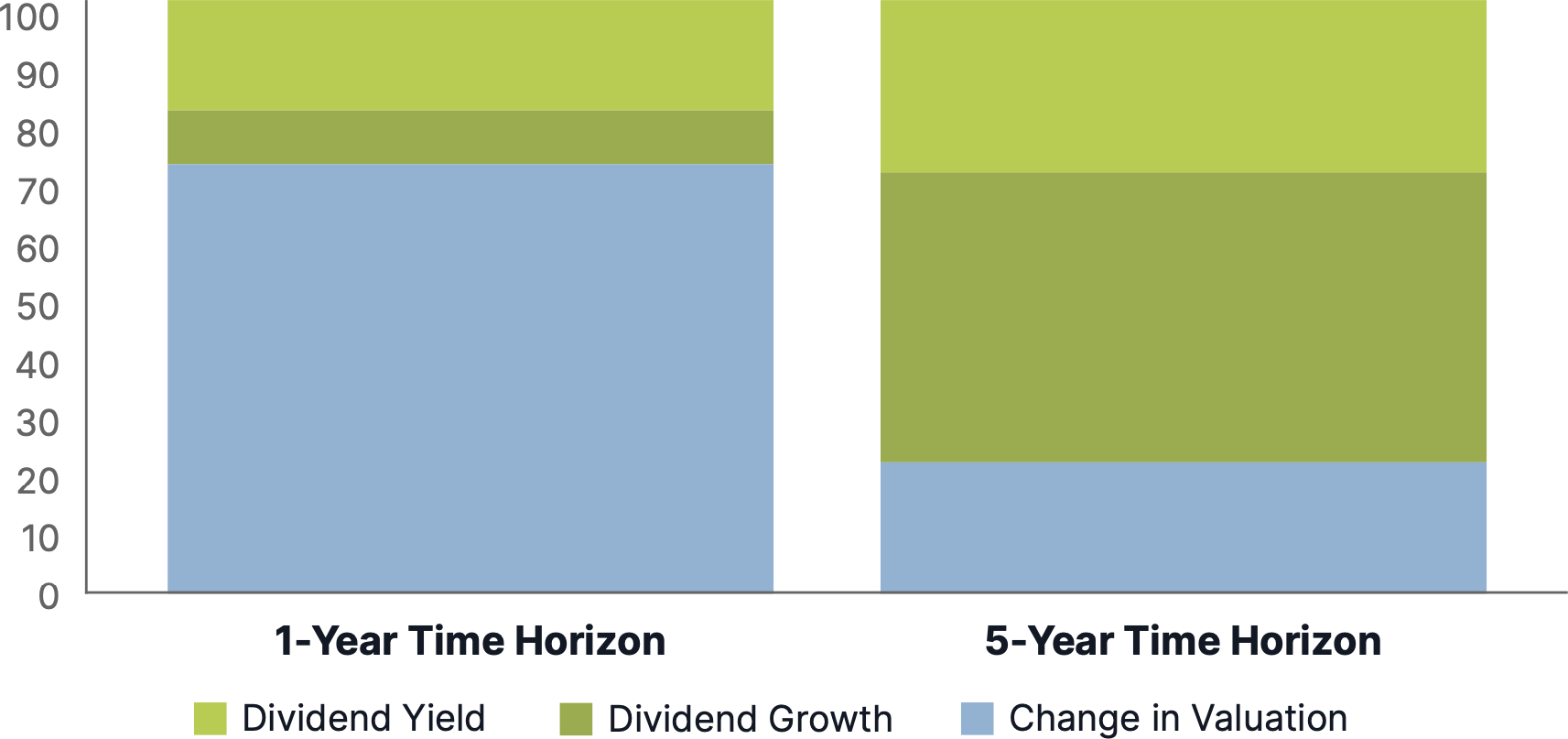

Long-Term Equity Returns and the Power of Dividends

Starlight Capital’s Approach to Dividend Investing: Dividend Growth Investing

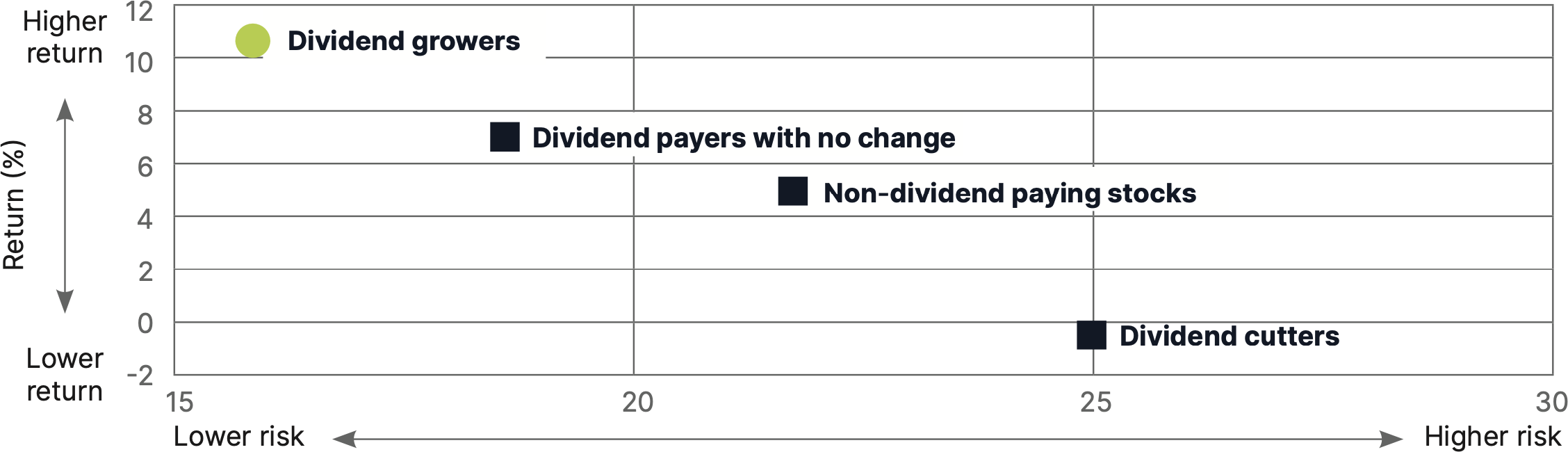

Risk vs return, annualized, 1973 - 2022

Why Invest in Dividend-Growing Companies?

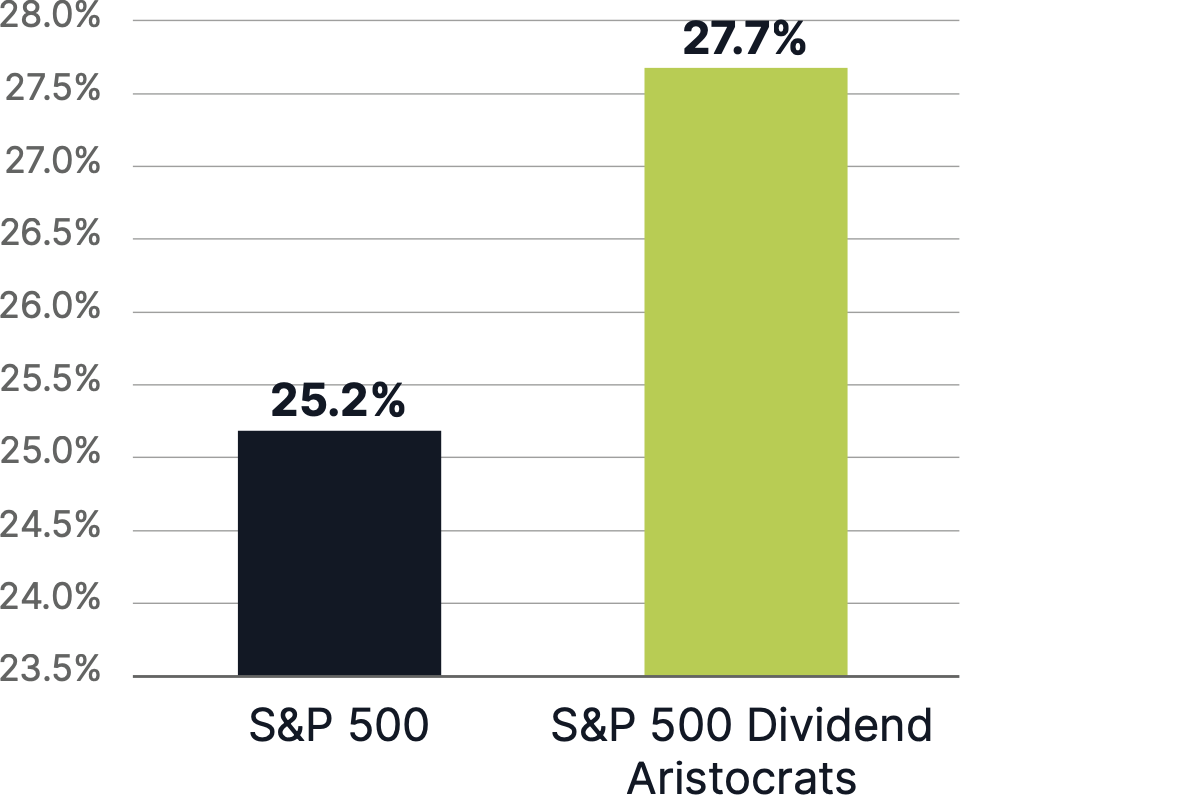

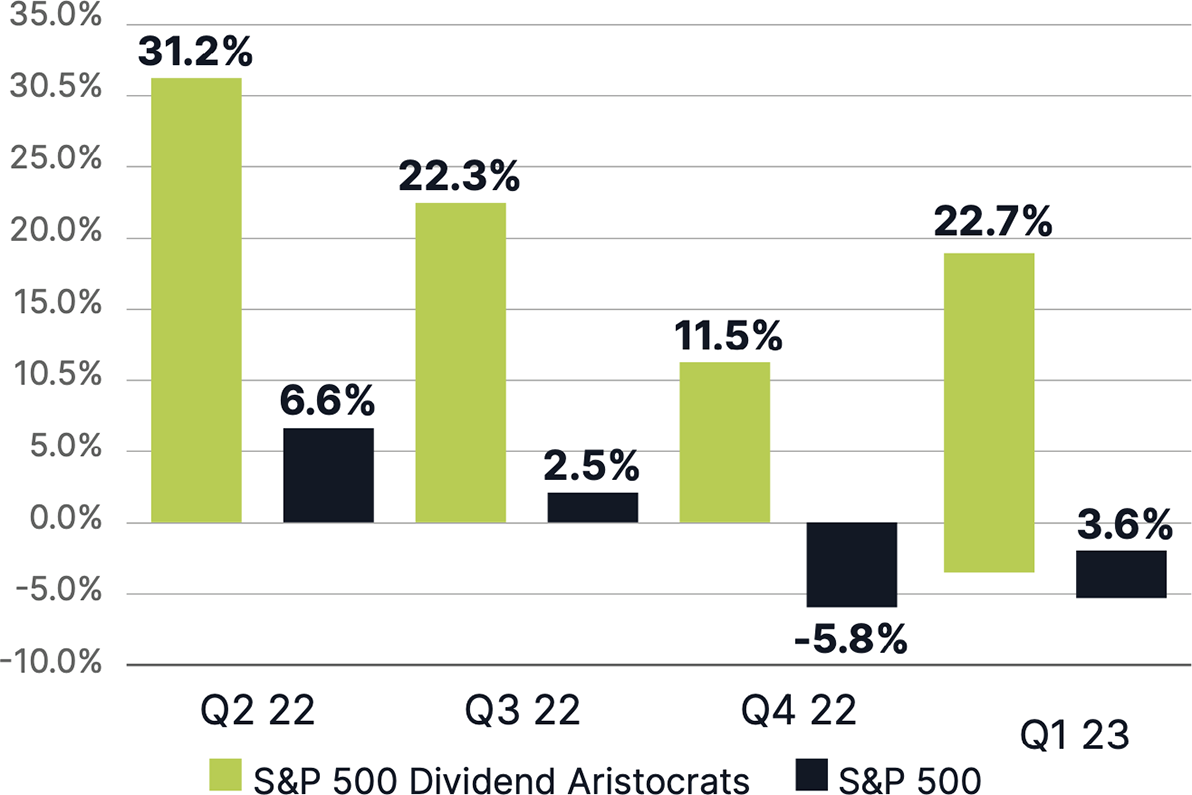

The S&P 500 Dividend Aristocrats are an elite group of large-cap companies that have increased their dividends for at least 25 consecutive years. Exhibit 3 provides evidence that these companies have consistently generated higher returns on equity than the companies in the S&P 500. The difference is even more striking when we look at quarterly earnings growth. In Q4 2022 the S&P 500 saw material earnings declines while the Dividend Aristocrats enjoyed very strong earnings growth.

Beware of Unsustainable Payouts

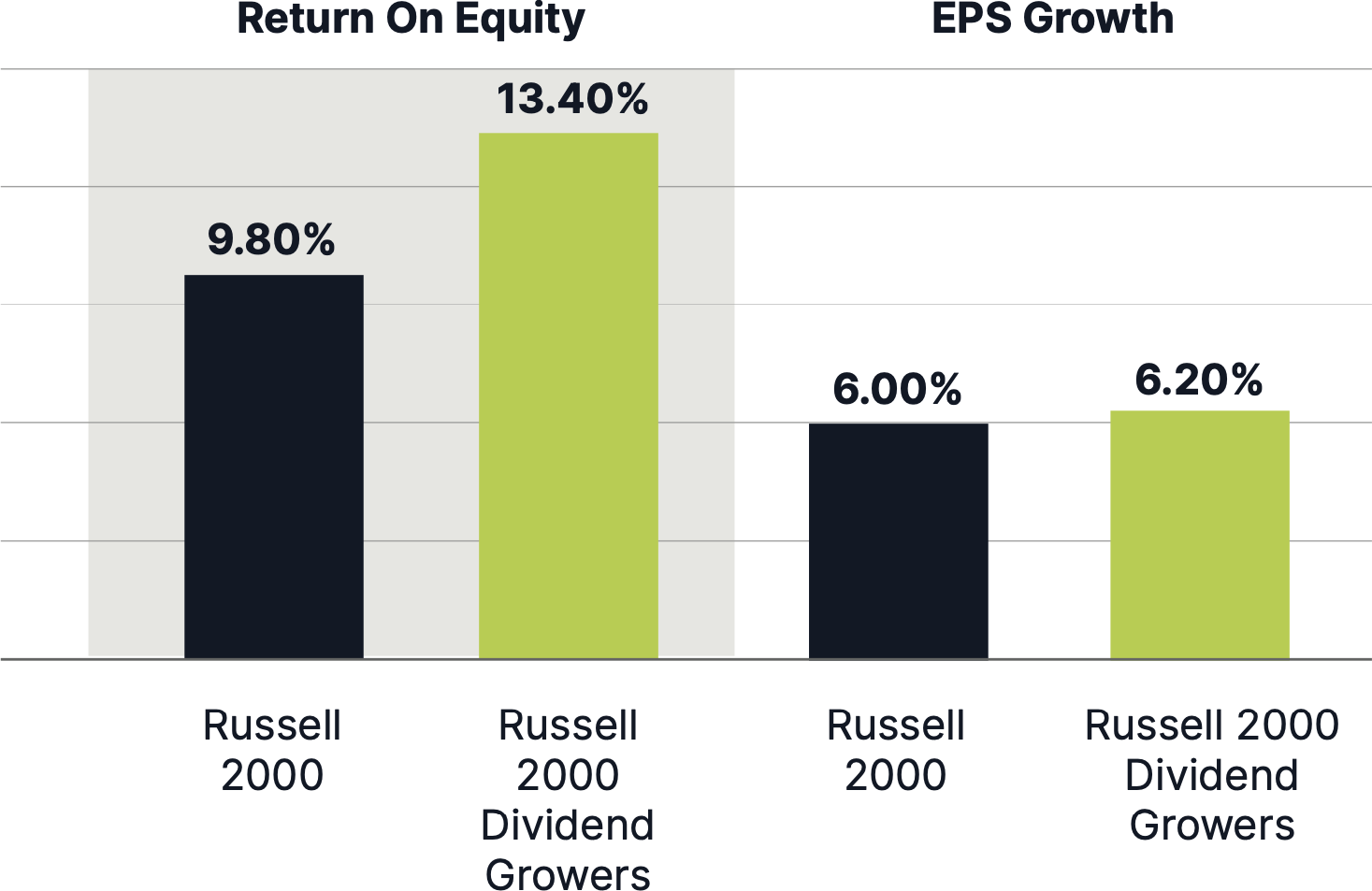

Small and Mid-Cap Dividend Growers Advantage

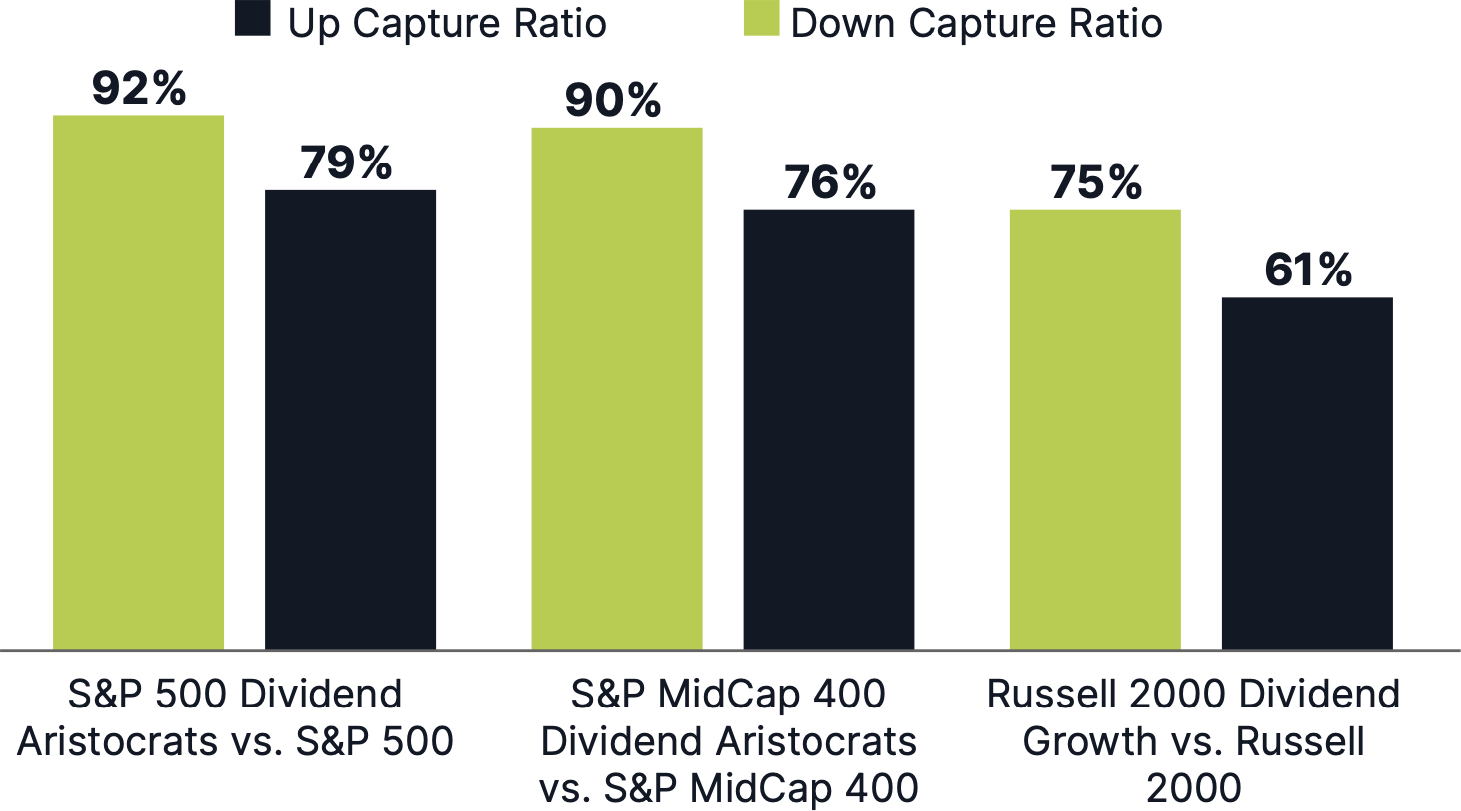

Index Dividend Growers Delivered Strong Up/Down Capture Ratios

(Inception - June 30, 2022)

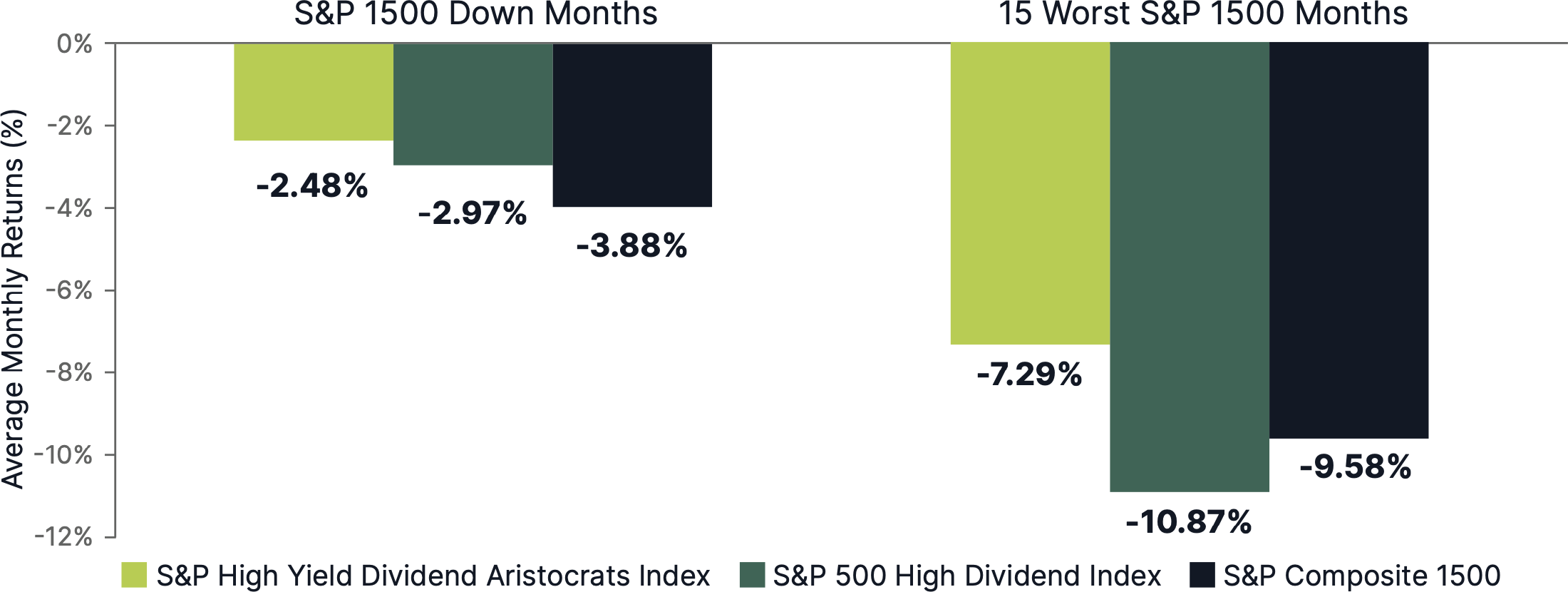

All-Weather Portfolios Start with Dividend Growth Stocks

Unlike high-yield stocks that may sacrifice long-term growth for current income, dividend growth stocks are often industry leaders with strong balance sheets and durable competitive advantages. Their consistent reinvestment in core operations and disciplined capital allocation help drive both cash flow and dividend growth, compounding investor returns over time.

In an all-weather portfolio, these stocks contribute meaningfully to total return, especially when capital appreciation is muted. During downturns, their stability and income generation can help offset losses in more cyclical or speculative holdings. In upcycles, they provide participation in market gains while maintaining defensive characteristics.

Sectors such as consumer staples, industrials, and healthcare, with secular demand drivers and pricing power, are home to many dividend growth companies. These companies have historically raised dividends through various economic environments, underscoring their role in anchoring long-term portfolios with both growth and downside protection.

Starlight Dividend Growth Class: Targeting 10%+ Sustainable Dividend Growth

Starlight Capital was founded to provide Canadian investors with the ability to invest in dividend growth mandates to drive superior, long-term risk-adjusted total returns. Starlight Dividend Growth Class has generated a 20+ year track record of strong performance. Driving this performance is the focus on dividend growers and our proprietary investment philosophy that focuses on high-quality companies with enduring competitive advantages. The Fund is used as a core holding for Canadian portfolios, complementing all investment styles.

Access Dividend Growth with Starlight Capital

Starlight Capital is an independent Canadian asset management firm with over $1 billion in assets under management. We manage Global and North American diversified private and public equity investments across traditional and alternative asset classes, including real estate, infrastructure and private equity. Our goal is to deliver superior risk-adjusted, total returns to investors through a disciplined investment approach: Focused Business Investing.

Focused Business Investing means we invest in great businesses when they offer us enough return for the risk we are exposed to. Great businesses are characterized by strong recurring cash flow, irreplaceable assets, low leverage, and strong management team. The result is concentrated portfolios of great businesses that reward investors with rising dividends.

Investment Objective:

To achieve above average long-term capital growth that is consistent with a conservative investment philosophy encompassing a diversified portfolio approach. The Fund invests primarily in equity securities of Canadian companies that demonstrate financial strength and good growth potential.

Fund Codes

Series A (SLC515)

Series F (SLC517)

Series FT6 (SLC5176)

Series FT8 (SLC5178)

Series T8 (SLC5158)

Series PTF (SCDGC)

Series ETF (SCDG)

Distribution Frequency

Monthly

The views in this update are subject to change at any time based upon market or other conditions and are current as of June 16, 2025. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.