RESP Facts

A Registered Education Savings Plan (RESP) is a tax-sheltered investment plan that can help families save for their children's post-secondary education.

Terms

Beneficiary: The student using the RESP for funding their post-secondary education

Subscriber: The person who opens an RESP on behalf of the beneficiary

Facts

- To open an RESP, you need the child's Social Insurance Number

- At the time the RESP is opened, the child must be a resident of Canada

- Lifetime contribution limit for each beneficiary is $50,000. There is no annual limit

- Contributions made to an RESP are not tax-deductible but grow tax free

- The beneficiary, who will typically have little income as a student, will likely pay minimal or no tax on the withdrawal

- When you save within an RESP, the Government of Canada will match a percentage of your own contributions by depositing the Canada Education Savings Grant (CESG) directly into the RESP

- Add that to the benefit of tax-sheltered compounding growth and you have a pretty compelling case to choose an RESP.

Family RESP

- Can have one or more beneficiaries who are related by blood or adoption to the subscriber(s)

- Beneficiary must be under age 21 to be added to the plan

- CESG and income are shared by all beneficiaries in the plan

Individual RESP

- Can only have one beneficiary who does not have to be related to the subscriber

- No age limit for the beneficiary to be added to the plan

- Annual maximum of $1,000 if carry-forward room is available

- $7,200 lifetime maximum per beneficiary

- Beneficiaries are eligible up to the end of the calendar year in which they turn 17

Canada Learning Bond (CLB)

- Eligibility for the CLB is based, in part, on the number of qualified children and the adjusted income of the primary caregiver

- $500 initial bond plus $100 per eligible year up to age 15 of the beneficiary

- Must apply before the beneficiary turns 21

When the Child Goes to Post-Secondary Education:

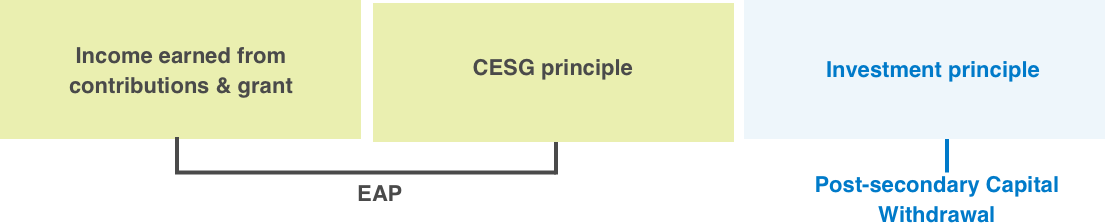

- There are two types of withdrawal options:

- Educational Assistance Payment (EAP)

- Post-secondary Capital Withdrawal.

RESP Total Account Value

Education Assistance Payment (EAP)

An EAP may consist of earnings or "accumulated income" and the grant itself. When withdrawn, this money is taxed in the hands of the beneficiary. Proof of enrolment in a post-secondary institution is required.

Post-Secondary Capital Withdrawal

A Post-secondary Capital Withdrawal is a withdrawal of contributions made by the subscriber while a beneficiary is eligible to receive EAPs. The subscriber may withdraw their contributions without repaying any grant amounts.

Opting Out of Post-Secondary Education

- If the beneficiary decides not to pursue a post-secondary education, the subscriber has several options, including:

- Name a new beneficiary. The former and new beneficiaries must be under the age of 21 and related to the subscriber. All grant money will be transferred to the new beneficiary.

- Transfer the earned income. The subscriber may transfer up to $50,000 of the earned income into an RRSP or a Spousal RRSP (if their contribution limit has room). All grant money is returned to the Government of Canada.

- Withdraw the money. While grant money will be returned to the government, the money earned on the grant remains with the subscriber.