Pension Income Splitting

Tax & Estate

Pension Income Splitting

In 2006, the federal government introduced a new planning opportunity for Canadian seniors - the ability to split pension income. This Infopage explains pension income splitting and how it can help to lessen your tax burden.

Under Canadian tax law, everyone files his or her own tax return and is taxed on the income he or she earns on an individual basis. Since we have a progressive tax system, the more you make, the higher your tax rate.

This has always been a source of concern for senior couples, where one of them receives a pension and the other has little or no income. The couple would pay significantly less tax if the pension income, which is being used to support the couple jointly, could be split between both partners.

Eligible Pension Income

Under current rules, any Canadian resident who receives income that qualifies for the existing $2,000 pension income credit (see page 3, “Pension income credit (PIC)”) is entitled to allocate to his or her resident spouse or common-law partner up to one half of his or her “eligible pension income.”

What is eligible pension income? The definition essentially mirrors the definition of eligible pension income for the purposes of the federal pension credit. Based on the type of income received and the age of the pension income recipient, eligible pension income is divided into two subsets and defined as either qualified pension income or pension income.

Recipients under age 65 – a subset of eligible pension income defined as qualified pension income:

- pension income from a registered pension plan (RPP) (i.e., a pension from an employer-sponsored defined benefit or defined contribution plan); and

- pension income from a specified pension plan (SPP), which includes the Saskatchewan Pension Plan.

Recipients under age 65 – a subset of eligible pension income defined as qualified pension income:

- pension income from a RPP;

- pension income from a SPP;

- income from an annuitized registered retirement savings plan (RRSP);

- registered retirement income fund (RRIF) withdrawals or withdrawals from RRIFs subject to federal or provincial locked-in legislation, such as life income funds (LIFs) and locked-in retirement income funds (LRIFs);

- income from an annuitized deferred profit sharing plan (DPSP);

- income from retirement compensation arrangements (RCAs)1; and

- a payment from a pooled registered pension plan (PRPP).

The purpose of the age 65 requirement for RRSP annuity, RRIF and LIF income is to target the pension income credit to retired individuals.

Since individuals have much greater personal control over timing of withdrawals under RRSPs, RRIFs and LIFs compared to RPPs, without the age 65 rule non-retirees could gain tax advantages through income splitting well before age 65. One way, for example, is by withdrawing RRIF income annually while still saving for retirement.

On the other hand, pensioners who receive RPP income generally have little control over timing of their pension payments, since they usually (although not always) only receive such payments when retired.

The following types of income are not eligible for pension income splitting:

- Old Age Security (OAS)

- Guaranteed Income Supplement (GIS)

- Canada Pension Plan (CPP)/Quebec Pension Plan (QPP)

- RRSP annuities, RRIFs and DPSP annuities (if recipient is under age 65)

- RRSP withdrawals

During the year, pension income continues to be paid directly to the pensioner. At tax-reporting time, spouses use Canada Revenue Agency (CRA) Form T1032 (“Joint Election to Split Pension Income”) to jointly elect how much pension income to split, including a reallocation of any withheld taxes so that the effects are felt immediately on filing rather than waiting for a tax refund.

The election to split pension income is made one year at a time. It can be changed or modified each tax year, depending on financial circumstances and planning needs. The ability to split (or not to split) any amount up to half of one’s eligible pension income presents a huge opportunity to maximize tax planning for seniors. One such area of planning involves OAS clawbacks.

Pension Income Credit (PIC)

The PIC provides a non-refundable reduction in taxes payable on eligible pension income. Since 2007, the maximum amount of eligible pension income that qualifies for the credit is $2,000.

Planning Opportunity 1

How can you take advantage of this PIC without actually receiving any pension income in the traditional sense? If you’re 65 or older, ensure you receive at least $2,000 a year from a RRIF. If you’re aged 65 to 70, consider transferring some of your RRSP money to a RRIF so you’ll be in position to claim this credit.

Planning Opportunity 2

CPP/QPP Sharing

While CPP/QPP income doesn’t qualify as eligible pension income for either the pension income credit (PIC) or pension splitting, existing rules do permit CPP/QPP recipients to split their CPP/QPP retirement benefit. Under these rules, spouses and common-law partners who are both at least 60 years of age can share up to half of their CPP/QPP retirement benefit. The split between partners is determined by the number of years they lived together during the period they were required to contribute to the CPP/QPP.

OAS Clawback Planning

The OAS clawback only kicks in at net income greater than $95,323 in 2025. It’s fully clawed back when net income reaches approximately $152,062 (ages 65-74) or $157,923 (age 75+).

The new possibility of being able to split pension income may be extremely beneficial for individuals subject to the OAS clawback. Why? Pension income that pushes an individual above $95,323 could now potentially be transferred to a lower-income spouse or partner’s income tax return, thus preserving OAS payments.

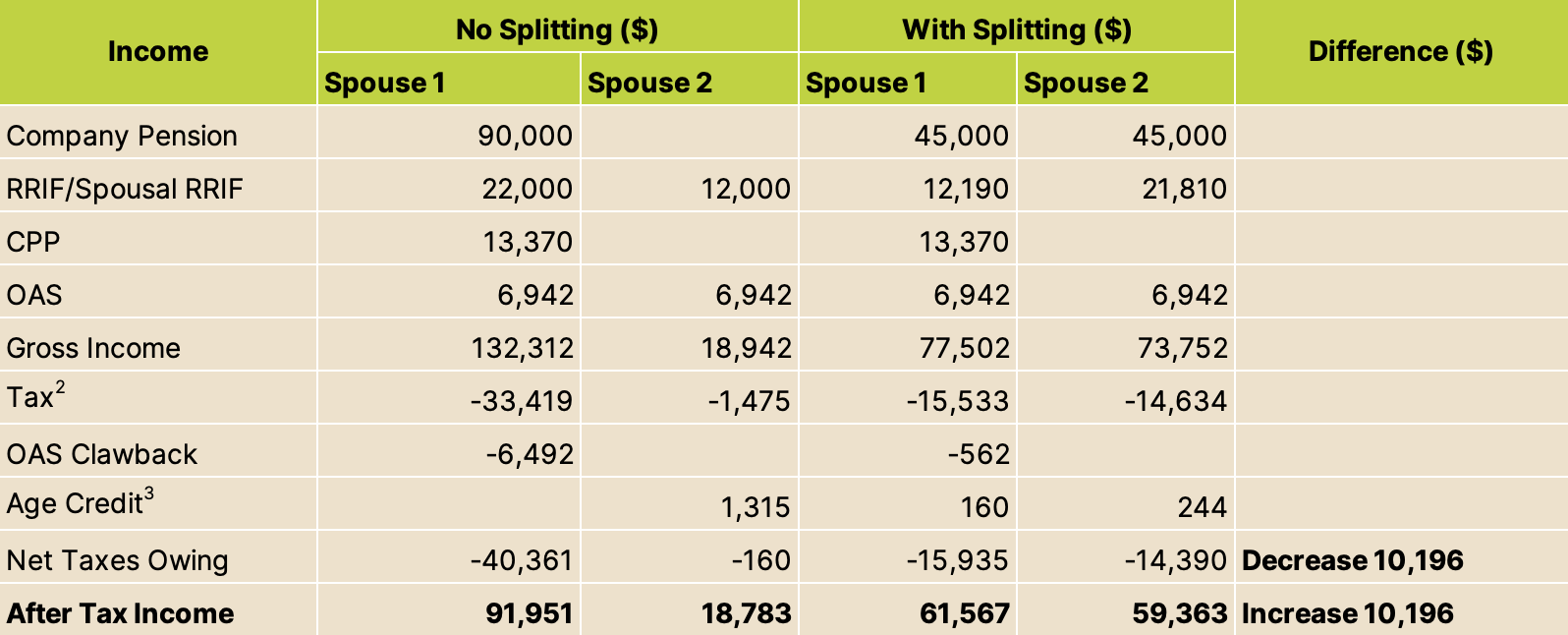

Here are two examples taking into account tax credits for the basic personal exemption, age credit and pension income credit, where applicable.

Both spouses are age 65 or older. The maximum benefit occurs by splitting just enough income to fully utilize the lower tax brackets and avoid an OAS clawback for spouse 2.

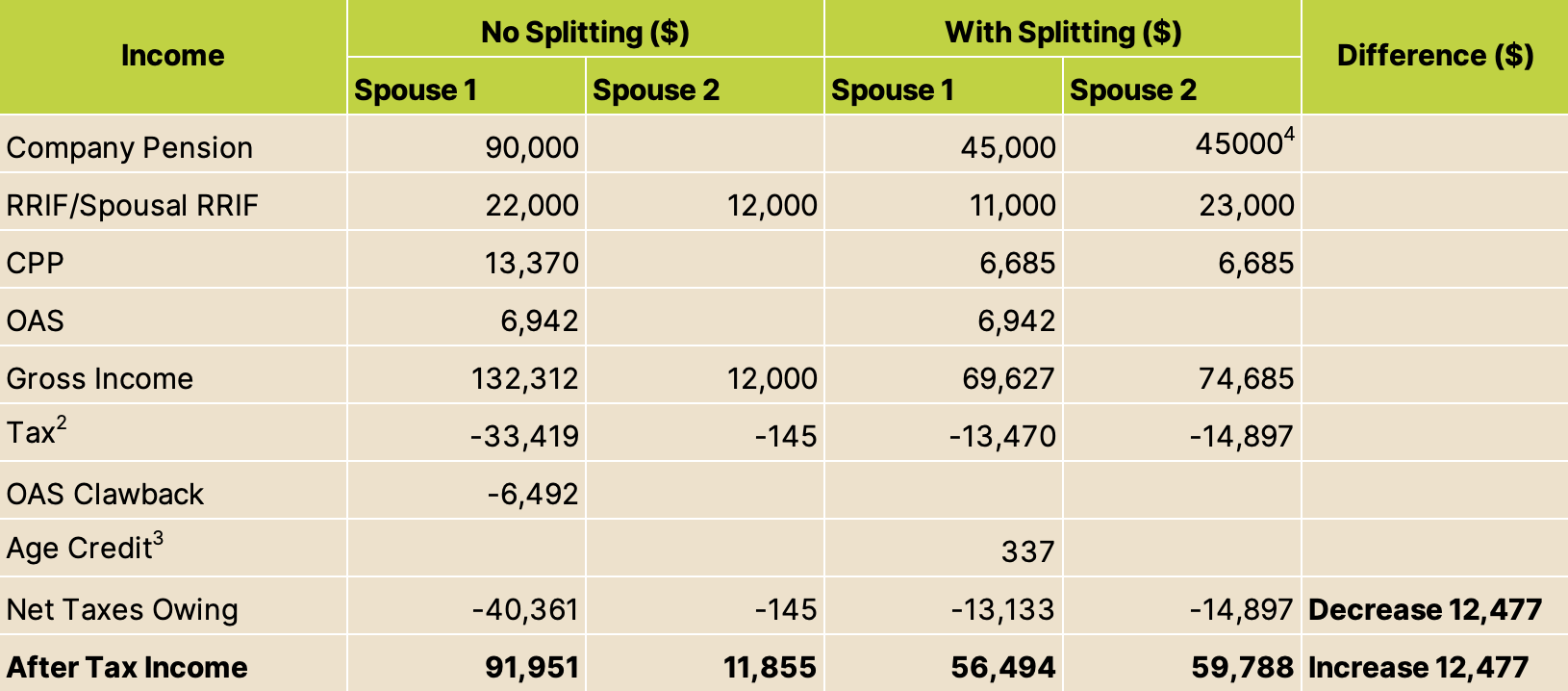

Example 2:

Spouse 1 is 65 or older and spouse 2 is between age 60 and 65. A full 50 per cent split can maximize the tax benefits since no OAS clawbacks or age credits apply to spouse 2 and can eliminate the OAS clawback for spouse 1.

2 Taxes owing are calculated using graduated rates for the province of British Columbia taking into account the Basic Personal Exception and the Pension Income Credit ($351) if applicable. Generally others will also apply.

3 The Age Credit is $1,315 less clawbacks.

4 Even though under age 65, Spouse 2 now has a Pension Income Credit on the transferred Company pension income.

Future of Spousal RRSPs

In light of these rules, have spousal RRSPs become a thing of the past? Are they still needed and, if so, in what capacity?

As a quick refresher, a spousal (or common-law partner) RRSP is a plan in which one spouse or partner has contributed and the other spouse or partner is the annuitant or owner. It’s often used by couples to accomplish post-retirement income splitting, as funds withdrawn from a spousal RRSP are taxed in the hands of the annuitant spouse instead of the contributor spouse. If the annuitant spouse is in a lower tax bracket than the contributor spouse in the year of withdrawal, there may be an absolute and permanent tax savings. The rules have not heralded the death of spousal RRSPs, primarily due to the definition of eligible pension income that qualifies to be split, as discussed earlier.

Splitting Under Age 65

Remember, if you’re under 65, eligible pension income typically includes only payments from an RPP and will not generally include amounts paid from an RRSP or RRIF. Anyone who wants to retire before age 65 and doesn’t have an RPP should still consider the use of spousal RRSP contributions that would allow the ultimate withdrawals to be taxed in a lower-income spouse’s or partner’s hands without having to wait until age 65.

Splitting More Than 50%

Spousal RRSPs also continue to play a role for individuals who may wish to split more than 50% of their pension income. With a spousal RRSP, one could transfer up to 100% of one’s RRSP income to a lower-income spouse or partner. This may be advantageous to some couples, depending on their individual retirement incomes and tax brackets.

Contributors Over Age 71

Spousal RRSPs may also play a critical role if you’re over age 71 – the age when you can no longer have an RRSP in your own name. You can, however, continue to contribute to a spousal RRSP if you have RRSP contribution room beyond age 71.

In fact, with many seniors working well into their 70s, you may still be generating “earned income” and thus be able to contribute to a spousal RRSP as long as your spouse or partner is under age 72. And keep in mind, you don’t necessarily have to be working to have earned income. You might simply own a rental property that generates net rental income, which is specifically included in the definition of earned income for the purposes of calculating eligible RRSP contribution room.

Home Buyers’ Plan (HBP) Withdrawals

Another continuing advantage of spousal RRSPs can be for younger couples looking to save enough money for a down payment on a first home. Often, their only savings are in an RRSP. If one spouse is working and the other isn’t, the working spouse, over the years of accumulation, could contribute a total of $25,000 to his or her own RRSP and then contribute $25,000 to a spousal RRSP while building up savings for the new home. Then each could withdraw $25,000 under the HBP – something that can’t be achieved without the spousal RRSP.

Post-Death RRSP Contribution

Finally, the spousal RRSP still plays a role in situations where individuals die with unused RRSP contribution room. In this scenario, the executor or estate representative can make an RRSP contribution to a surviving spouse’s or partner’s spousal RRSP and obtain one final RRSP deduction on the deceased’s terminal return.