Role of an Advisor

A professional financial advisor can help you set realistic goals and understand the investment products that make sense for your portfolio, and then help you monitor and understand how your investments have performed. With a trusted advisor and a financial plan tailored to your goals, you’re on your way to better financial health.

Why Work With an Advisor?

Working with a financial advisor can provide you with a better chance of:

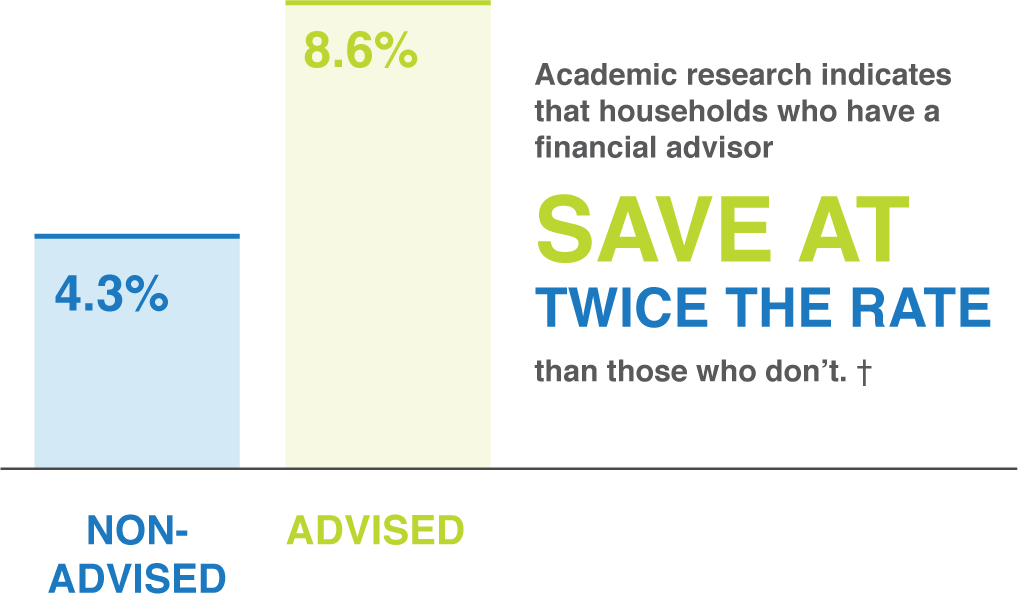

- Accumulating greater wealth through better saving behaviour

- Building assets for a more comfortable retirement

- Selecting tax-efficient investment vehicles

- Maintaining a long-term investment strategy

- Protecting against poor financial decisions

- Avoiding emotional investing habits

Source: IFIC Value of Advice Report, 2012.

Advice Matters

Obtaining good advice can help you make better decisions.

It can help you avoid mistakes, turn challenges into opportunities and solve problems. Financial advisors provide convenient access, counsel and guidance to help investors grow their financial assets and play an important role in helping you develop greater savings discipline.

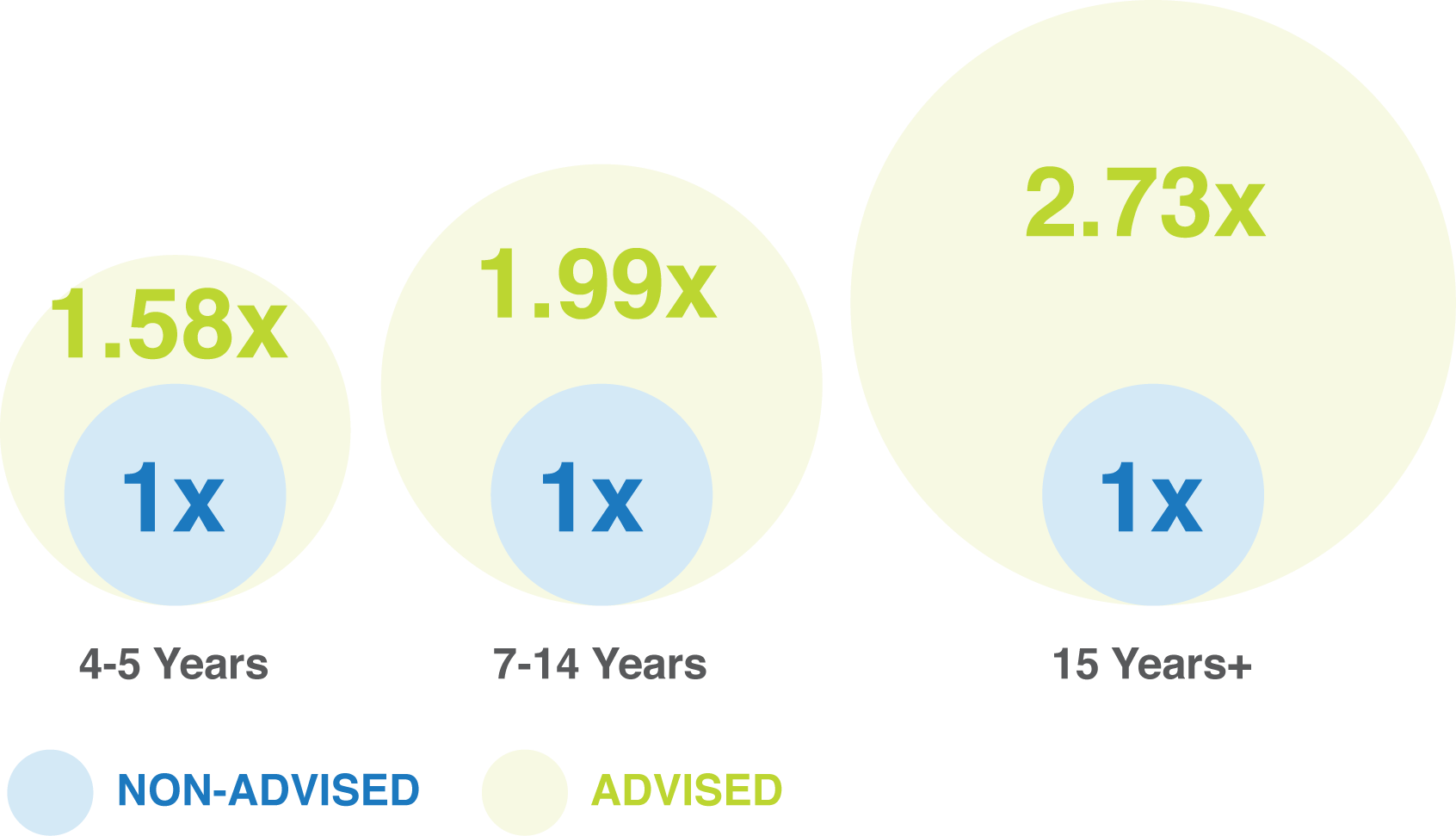

Investors who receive advice are much better off when they have an advisor – and the longer that relationship lasts, the better.

In fact, research shows that investors who work with an advisor

ACCUMULATE 2.73X MORE ASSETS than those who don't.†

†Econometric Models on the Value of Advice of a Financial Advisor, CIRANO Institute, 2012.

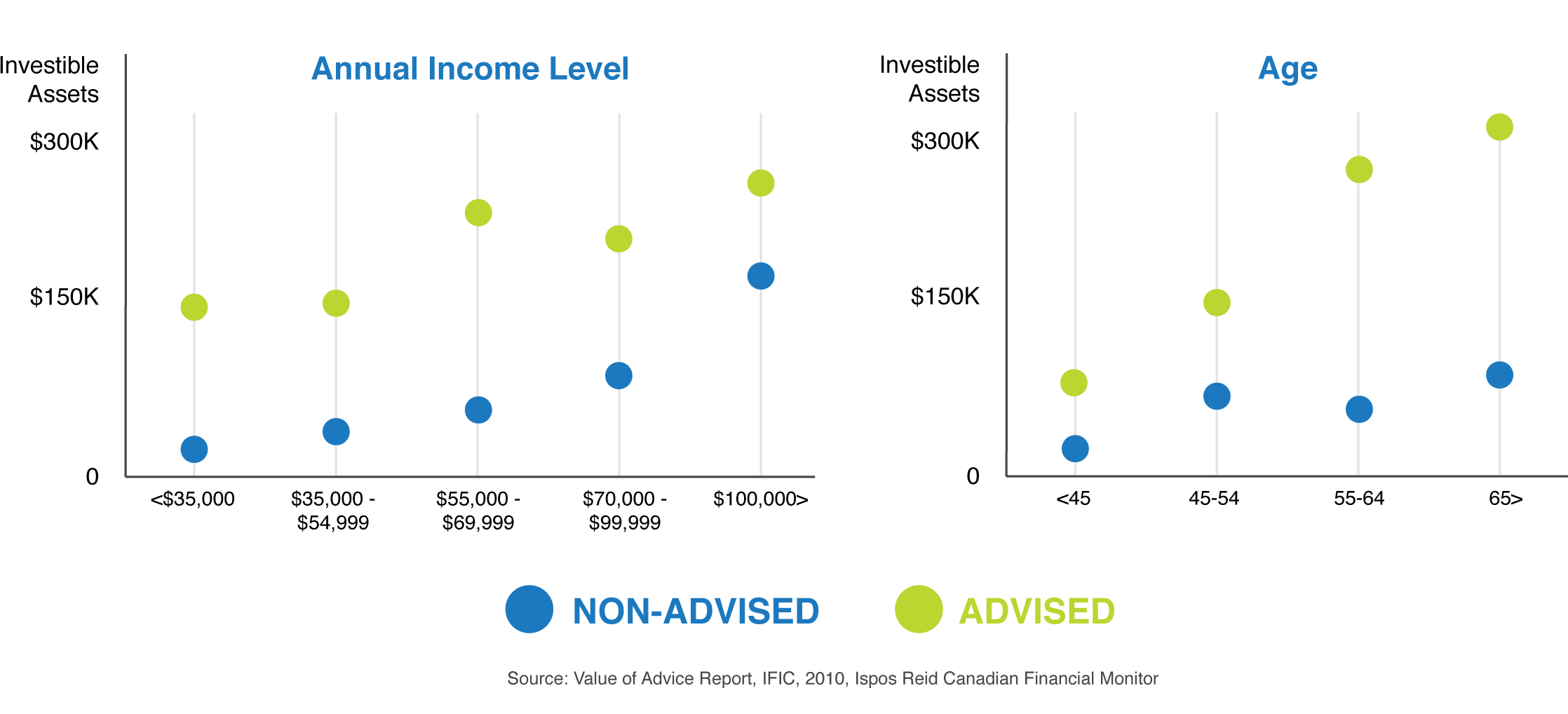

Higher Growth in Investable Assets Regardless of Income and Age

Source: Value of Advice Report, IFIC, 2010, Ispos Reid Canadian Financial Financial Monitor.

Mutual Funds Matter

Mutual funds provide easy access to innovative solutions managed by highly trained investment professionals, while protecting investor interests. They can fulfill the needs of any investor portfolio, from the smallest investment accounts to the most affluent households.

When you purchase a mutual fund, you also buy, the financial know-how and expertise of the portfolio manager. Managers who use an active management philosophy invest in a manner that is different from an index or benchmark, with the goal of outperforming the benchmark. An actively managed fund can provide substantial value and help differentiate investor portfolios.

- Product evolution to adapt to changing regime

- Adaptations to meet emerging investor needs

- Multitude of asset classes (fund categories)

- People with low assets can invest

- Strong advisor complement and alternative distribution channels

- Stewardship

- Highly regulated

- Financial literacy

- Highly trained

- Partnerships with academia

- Evidence-based research