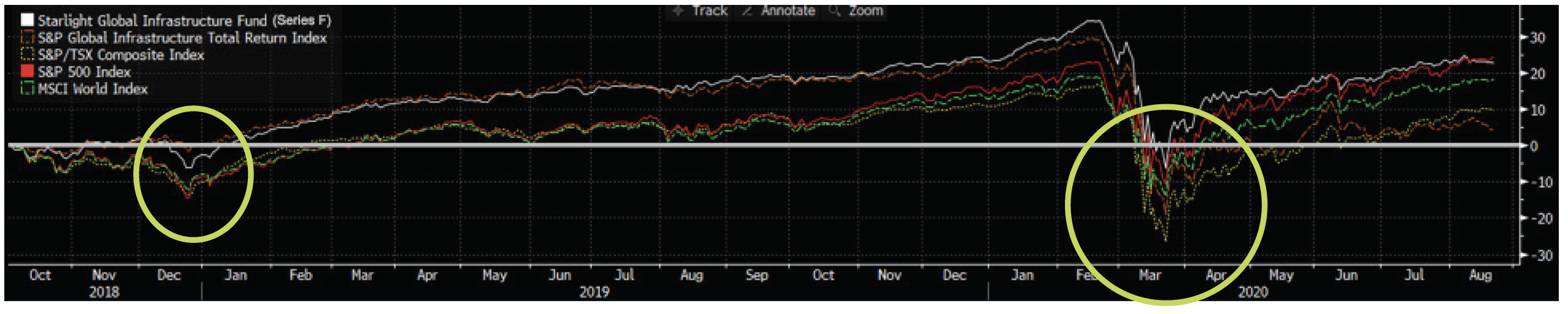

Starlight Investments Capital LP (“Starlight Capital”) is the manager of the Starlight Global Infrastructure Fund. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. The indicated rates of return are the historical annual compound total returns net of fees including changes in security value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus before investing. Investors should consult with their advisors prior to investing. Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Active share measures the percentage a portfolio’s holdings that are different from those in its benchmark. Active share shows how the manager is actively exploiting opportunities that are not reflected in the index. The benchmarks used for analysis for the Starlight Global Infrastructure Fund is the S&P Global Infrastructure Index (CAD).

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

Starlight mutual funds, exchange traded funds, offering memorandum funds and closed-end funds are managed by Starlight Investments Capital LP (“Starlight Capital”), a wholly-owned subsidiary of Starlight Investments. Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc. - August 2020.