Securing Recession-Proof and Resilient Returns in Waste Management

Understanding the Waste Management Ecosystem

Modern waste management extends far beyond simple “trash collection”. It encompasses the entire lifecycle of waste, including collection, sorting, processing, recycling, disposal, waste-to-energy (WTE), hazardous waste management, and other specialized services like medical and e-waste management.

This sector relies on essential infrastructure assets such as large-scale landfills, transfer stations, material recovery facilities (MRFs), and advanced waste-to-energy plants. These components are akin to utilities, powering and supporting urban and industrial activity.

The waste industry has three primary sources of generation: residential waste, commercial waste, and industrial waste. Together, these three sources generate different forms of waste commonly grouped into the following three categories:

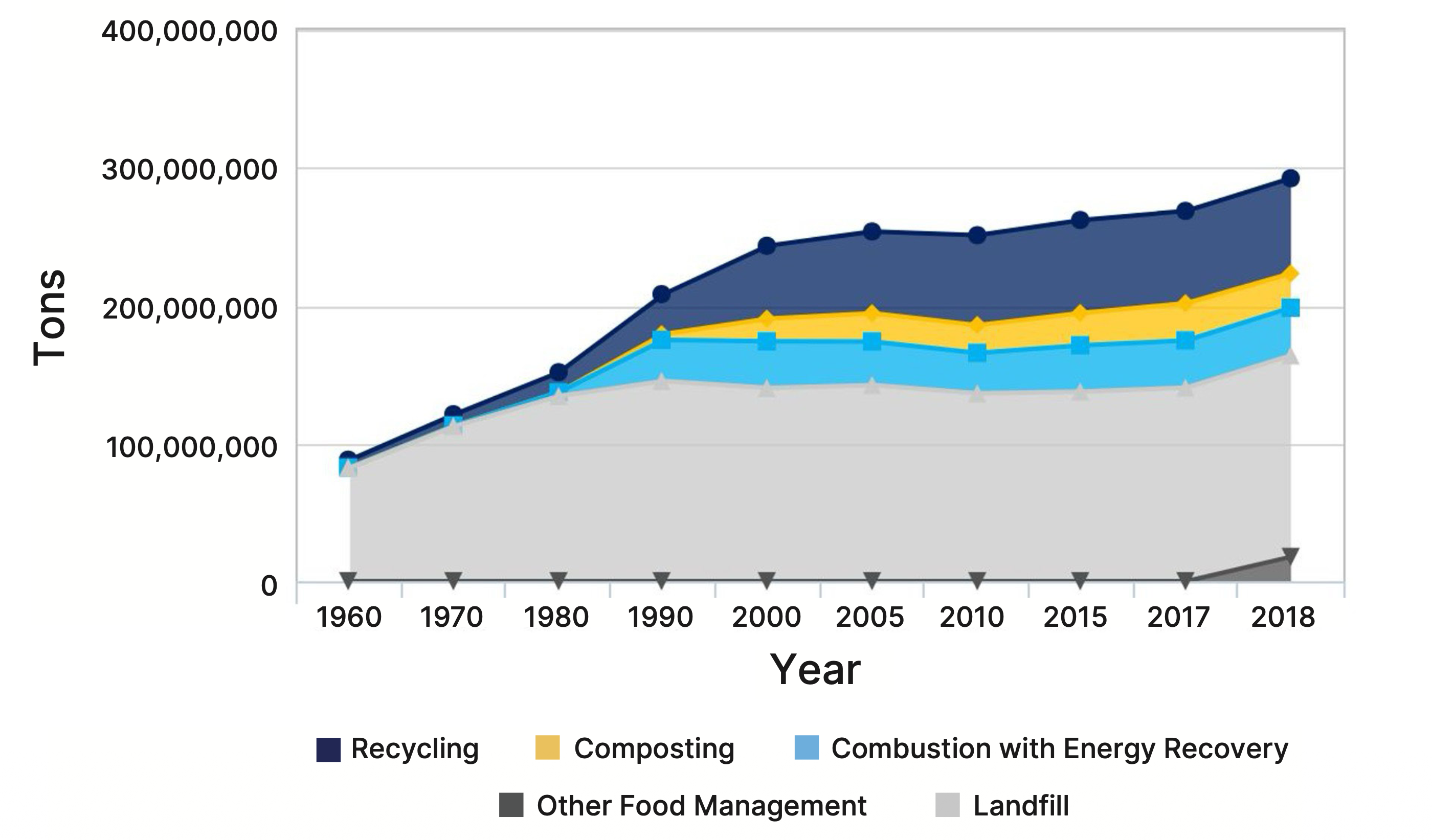

1. Municipal solid waste (MSW) consists of the everyday items we use and throw away such as product packaging, grass clippings, furniture, clothing, food scraps, newspapers, appliances and batteries. Municipal waste is primarily generated from residential and commercial sources. It is believed to account for over two-thirds of waste industry revenues. According to the EPA, the U.S. generates more than 292 million tons of waste per year, or 4.9 pounds per person per day with roughly one third of this amount being recycled and composted.

This sector relies on essential infrastructure assets such as large-scale landfills, transfer stations, material recovery facilities (MRFs), and advanced waste-to-energy plants. These components are akin to utilities, powering and supporting urban and industrial activity.

The waste industry has three primary sources of generation: residential waste, commercial waste, and industrial waste. Together, these three sources generate different forms of waste commonly grouped into the following three categories:

1. Municipal solid waste (MSW) consists of the everyday items we use and throw away such as product packaging, grass clippings, furniture, clothing, food scraps, newspapers, appliances and batteries. Municipal waste is primarily generated from residential and commercial sources. It is believed to account for over two-thirds of waste industry revenues. According to the EPA, the U.S. generates more than 292 million tons of waste per year, or 4.9 pounds per person per day with roughly one third of this amount being recycled and composted.

Municipal Solid Waste Management: 1960-2018

Source: EPA website. Last updated November 8, 2024.

2. Construction and demolition (C&D) waste includes a variety of materials generated from different sources such as construction, renovation, demolition and natural disasters. C&D waste is typically “event-driven” and is usually sourced as a form of industrial waste. The U.S. EPA estimated that C&D waste is more than twice the volume of MSW.

3. Hazardous Waste includes a variety of toxic chemicals that require special handling to be disposed of without adversely impacting the environment or human health.

3. Hazardous Waste includes a variety of toxic chemicals that require special handling to be disposed of without adversely impacting the environment or human health.

Why Waste Management is Recession-Proof and Resilient

The waste management industry demonstrates strong resilience and recession-proof characteristics due to several key factors:

1. Non-Discretionary Demand

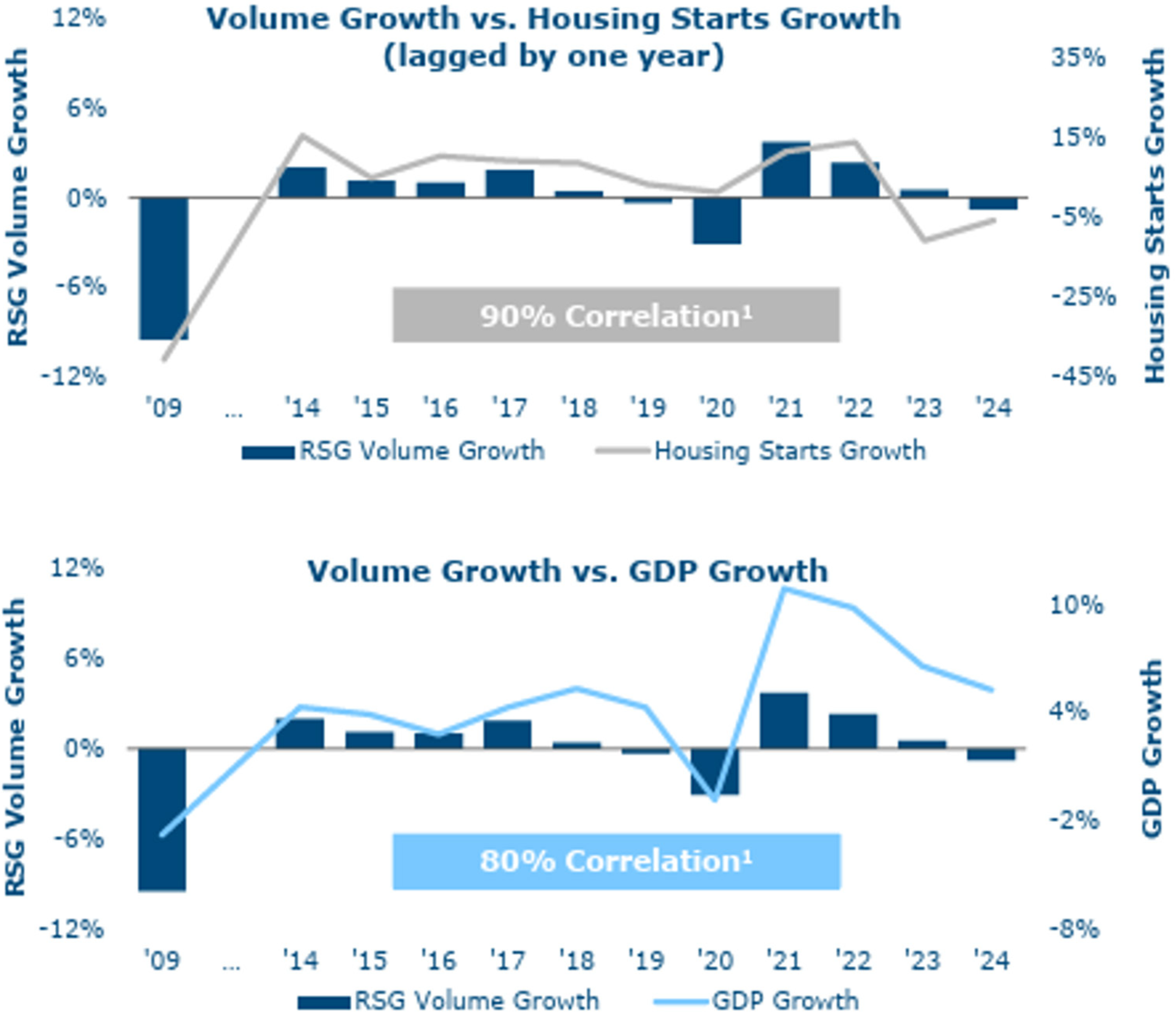

Waste generation remains constant regardless of economic cycles, as both businesses and individuals continuously produce waste. This leads to low correlation with broader economic cycles. While overall volume growth is driven by population growth, household formation, and new business formation, waste volumes are resilient during economic downturns. Residential volumes are the most stable, with commercial, industrial, and construction/demolition waste streams being more sensitive to economic activity.

1. Non-Discretionary Demand

Waste generation remains constant regardless of economic cycles, as both businesses and individuals continuously produce waste. This leads to low correlation with broader economic cycles. While overall volume growth is driven by population growth, household formation, and new business formation, waste volumes are resilient during economic downturns. Residential volumes are the most stable, with commercial, industrial, and construction/demolition waste streams being more sensitive to economic activity.

Republic Services Volume Growth vs. Housing

Source: Republic Services Investor Presentation. April 2025.

2. Regulatory Support and High Barriers to Entry

The waste management industry benefits from significant regulatory support and environmental regulations. Developing and operating landfills, for example, is capital-intensive and involves complex permitting processes. Federal regulations have made obtaining new landfill permits difficult, creating significant regulatory hurdles.

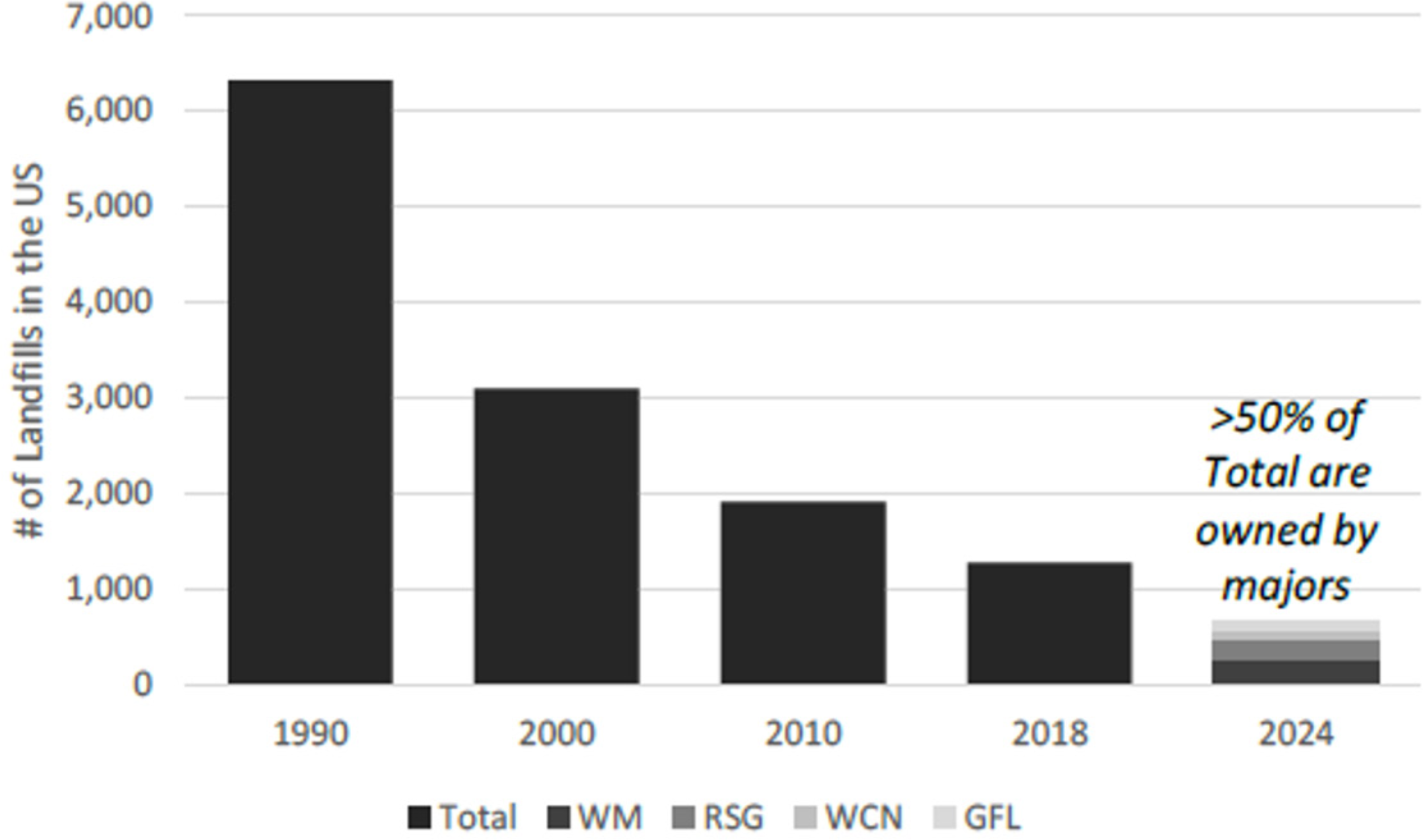

As shown in the graph below, total landfill capacity in the U.S. has exhibited a decreasing trend, one that is likely to continue even as waste volumes continue to rise. This scarcity grants landfill owners substantial pricing power and a higher proportion of the economic benefits within the value chain. In the U.S., approximately 1,270 municipal solid waste landfills exist, with the four major companies owning or operating over 50% of them. Furthermore, these major players are estimated to control over 80% of the permitted capacity (compared to approximately 40% in 2000).

The waste management industry benefits from significant regulatory support and environmental regulations. Developing and operating landfills, for example, is capital-intensive and involves complex permitting processes. Federal regulations have made obtaining new landfill permits difficult, creating significant regulatory hurdles.

As shown in the graph below, total landfill capacity in the U.S. has exhibited a decreasing trend, one that is likely to continue even as waste volumes continue to rise. This scarcity grants landfill owners substantial pricing power and a higher proportion of the economic benefits within the value chain. In the U.S., approximately 1,270 municipal solid waste landfills exist, with the four major companies owning or operating over 50% of them. Furthermore, these major players are estimated to control over 80% of the permitted capacity (compared to approximately 40% in 2000).

Landfill Capacity in the U.S. since 1990

Source: National Bank Report: Turning trash into Cash (May 2025).

3. Predictable Cash Flows and Built-in Protection

Waste management companies benefit from long-term contracts that provide predictable cash flows and built-in protection against inflation.

4. Strong Pricing Power

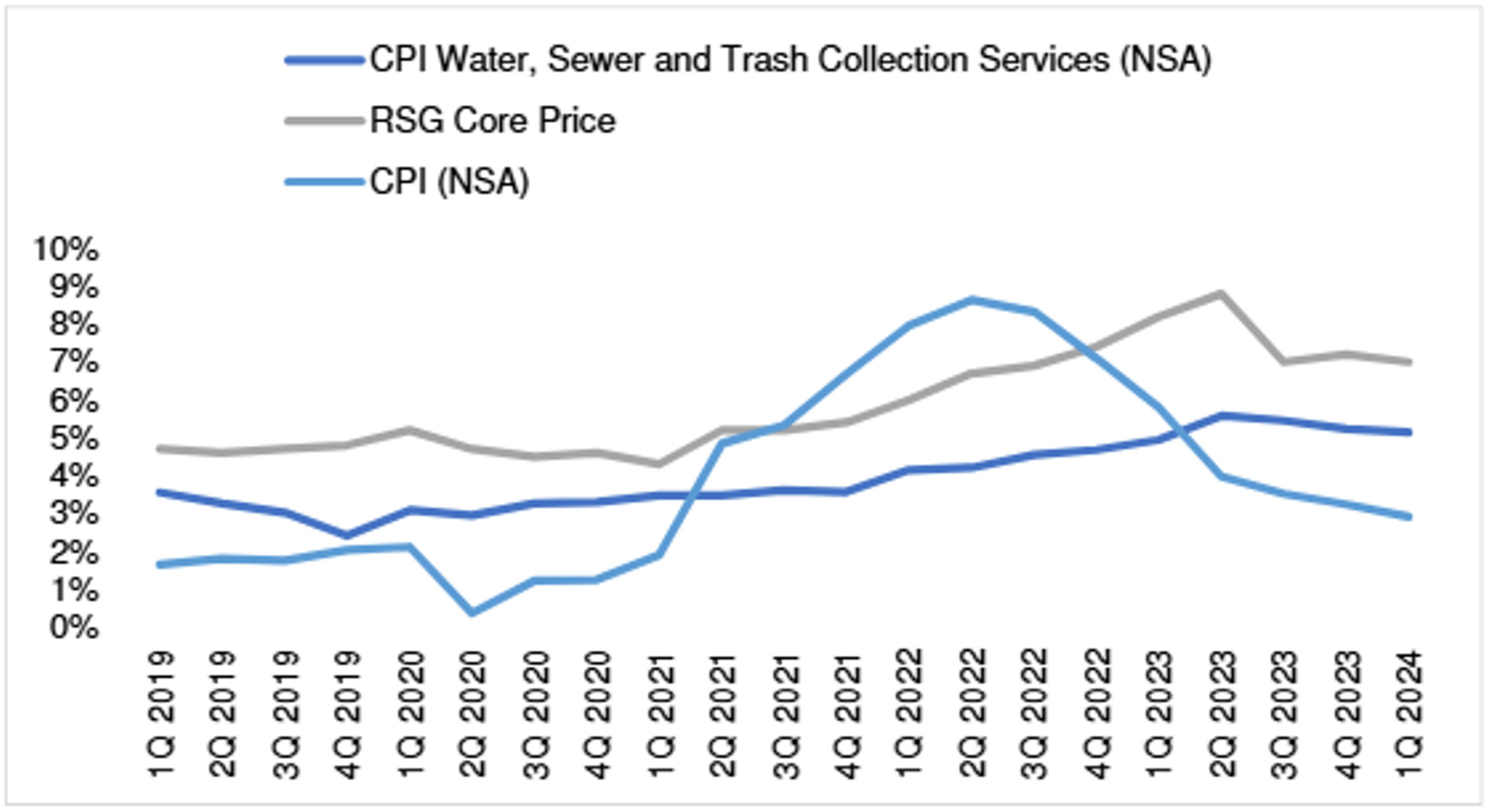

Waste management is an essential service and the cost of it is estimated to account for a small proportion of total residential and commercial operating costs. Price is therefore largely inelastic – the industry has demonstrated strong pricing power, with major waste companies realizing an average net price increase (or yield) of approximately 7% in the last three years. Even as inflation moderates, the industry is expected to sustain price/yield increases of 3.5% to 5.0%, supporting EBITDA margin expansion of 30 to 100 basis points per year.

Waste management companies benefit from long-term contracts that provide predictable cash flows and built-in protection against inflation.

- Commercial and Industrial Agreements: These contracts typically range from three to five years, often with automatic renewals. Pricing is based on collection frequency, volumes, weight, and equipment, and includes adjustments for CPI, fuel, and other factors.

- Municipal/Residential Collection Agreements provide curbside collection services for municipalities. Bidding for these contracts typically occurs 9 to 18 months before expiry and often comes with initial terms of three to ten years, with options for extensions. Pricing is determined by the number of households, collection frequency, and equipment type, and includes annual price escalators and periodic fuel price recalibrations. These contracts can generate EBITDA margins in the mid-to-high 20% range for major companies.

- Inflation Escalators: Contracts typically incorporate inflation escalators, with pricing managed through open-market or index-based mechanisms. Index-based contracts often utilize price escalators linked to CPI or other indices, typically with a 12-18 month lag. To counter persistent collection and disposal cost inflation, waste companies have been shifting customers towards alternative indices or fixed increases.

- Regional Economies of Scale: Given the importance of costs associated with the transportation of waste to treatment and disposal sites, having disposal capacity proximate to the waste stream provides a competitive advantage and serves as a barrier to entry. Therefore, companies will establish the landfill site as their base and seek to consolidate the market around it while also vertically integrating the entire value chain from collection through to disposal. Tuck-in acquisitions of smaller sub-scale players in adjacent markets drives growth through expansion of the footprint. The end result is competition is disincentivized as companies divide up the market into established regions where each player can capture high market share.

4. Strong Pricing Power

Waste management is an essential service and the cost of it is estimated to account for a small proportion of total residential and commercial operating costs. Price is therefore largely inelastic – the industry has demonstrated strong pricing power, with major waste companies realizing an average net price increase (or yield) of approximately 7% in the last three years. Even as inflation moderates, the industry is expected to sustain price/yield increases of 3.5% to 5.0%, supporting EBITDA margin expansion of 30 to 100 basis points per year.

Price Growth vs Inflation

Source: Deutsche Bank Report: Beneficiary of Strengthening Macro (May 2024).

Defensive Compounding

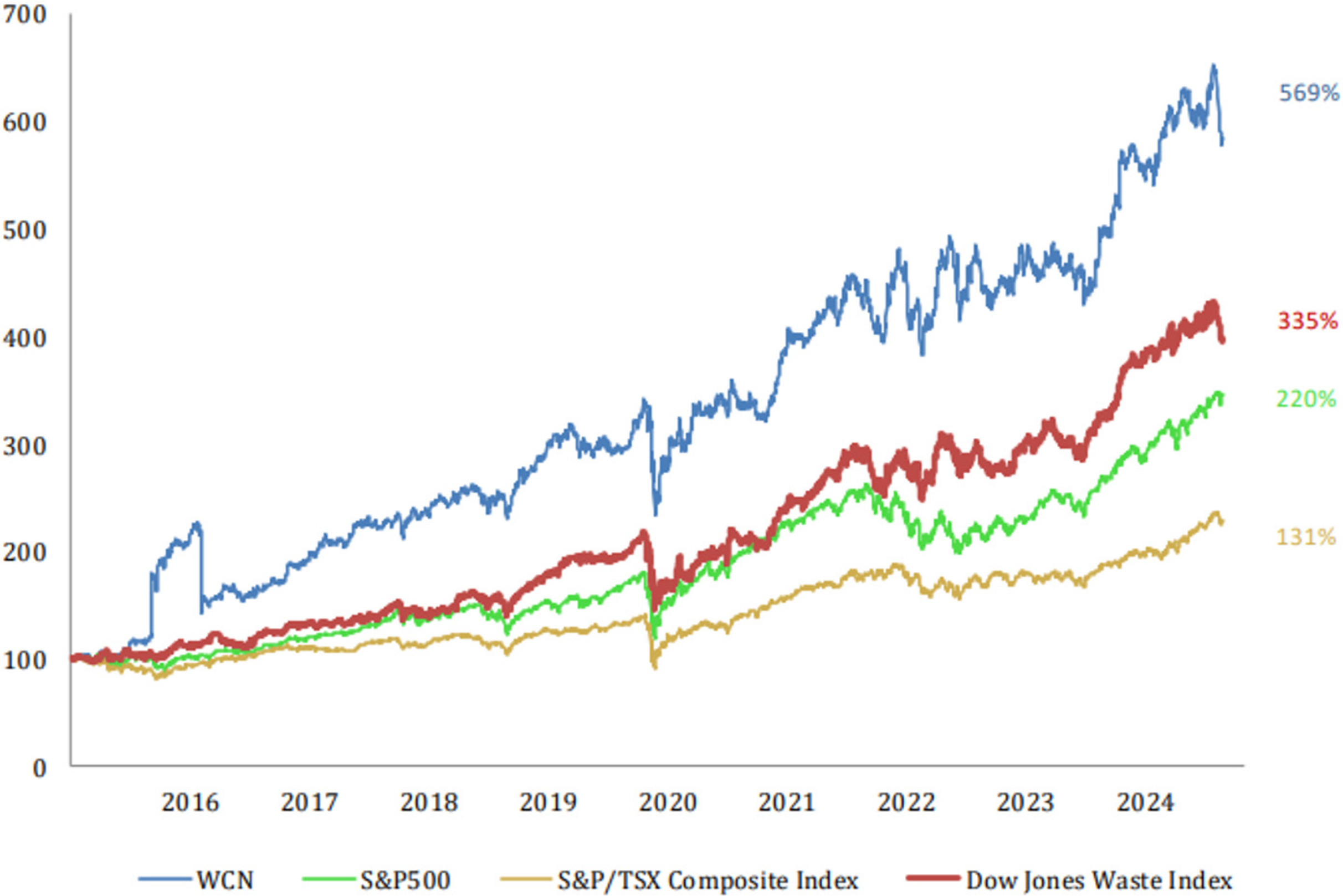

The current economic climate is marked by inflation concerns and market volatility, highlighting the need for stable investment opportunities. In this environment, the waste management sector stands out as a critical, yet often overlooked, area of the market offering consistent returns even when the broader economy faces headwinds. Underperformance relative to the market is infrequent and shallow, translating into cumulative outperformance.

Waste Connections 10-Year Total Shareholder Return as of April 30, 2025

Source: Waste Connections Investor Presentation. May 2025.

Growing Trends Driving Demand

Beyond traditional factors, several trends are further bolstering demand in the waste management sector.

1. Population Growth & Urbanization

Solid waste volume growth is significantly influenced by population growth and the formation of new households and businesses, tracking general economic growth in the U.S. and Canada.

2. Circular Economy

The increasing focus on the circular economy drives demand for waste-to-energy (WTE) and renewable natural gas solutions. In this context, waste byproducts are converted into renewable energy through various processes. Waste-to-energy facilities, for example, incinerate municipal solid waste to generate electricity and/or heat, recovering energy that would otherwise be lost. Landfill gas, a byproduct of decomposing organic waste in landfills, can be captured and processed into renewable natural gas (RNG) which can then be used as fuel or injected into natural gas pipelines.

3. Hazardous & Special Waste Management

The growing need for specialized handling of hazardous and other unique waste streams also contributes to demand. For example, Per- and polyfluoroalkyl substances (PFAS) are a group of synthetic chemicals used in a wide range of industrial and consumer products for their resistance to heat, water and oil. Known as “forever chemicals” due to their persistence in the environment, PFAS are scrutinized for their potential health and ecological risks. In the context of landfills, PFAS are a growing concern because they can leach into groundwater. Companies are in the process of realizing revenue growth opportunities associated with eliminating PFAS from waste streams in an ecologically sensitive manner.

1. Population Growth & Urbanization

Solid waste volume growth is significantly influenced by population growth and the formation of new households and businesses, tracking general economic growth in the U.S. and Canada.

2. Circular Economy

The increasing focus on the circular economy drives demand for waste-to-energy (WTE) and renewable natural gas solutions. In this context, waste byproducts are converted into renewable energy through various processes. Waste-to-energy facilities, for example, incinerate municipal solid waste to generate electricity and/or heat, recovering energy that would otherwise be lost. Landfill gas, a byproduct of decomposing organic waste in landfills, can be captured and processed into renewable natural gas (RNG) which can then be used as fuel or injected into natural gas pipelines.

3. Hazardous & Special Waste Management

The growing need for specialized handling of hazardous and other unique waste streams also contributes to demand. For example, Per- and polyfluoroalkyl substances (PFAS) are a group of synthetic chemicals used in a wide range of industrial and consumer products for their resistance to heat, water and oil. Known as “forever chemicals” due to their persistence in the environment, PFAS are scrutinized for their potential health and ecological risks. In the context of landfills, PFAS are a growing concern because they can leach into groundwater. Companies are in the process of realizing revenue growth opportunities associated with eliminating PFAS from waste streams in an ecologically sensitive manner.

A Pillar of Portfolio Stability

Given its unique characteristics, the waste management sector represents an essential, inherently resilient, and recession-proof investment. It provides predictable cash flows, built-in inflation protection, and insulation from economic downturns. Waste management companies perform well in recessions and low-growth environments, and comparatively better during periods of elevated inflation. This makes the industry an ideal component for any well-diversified portfolio seeking stability and consistent returns.

Access global infrastructure with Starlight Capital

Starlight Capital is an independent Canadian asset management firm with over $1 billion in assets under management. We manage Global and North American diversified private and public equity investments across traditional and alternative asset classes, including real estate, infrastructure and private equity. Our goal is to deliver superior risk-adjusted, total returns to investors through a disciplined investment approach: Focused Business Investing.

Focused Business Investing means we invest in great businesses when they offer us enough return for the risk we are exposed to. Great businesses are characterized by strong recurring cash flow, irreplaceable assets, low leverage, and strong management teams. The result is concentrated portfolios of great businesses that reward investors with rising dividends.

Starlight Global Infrastructure Fund is an opportunity to invest in large assets that provide essential services in cities throughout the world.

Focused Business Investing means we invest in great businesses when they offer us enough return for the risk we are exposed to. Great businesses are characterized by strong recurring cash flow, irreplaceable assets, low leverage, and strong management teams. The result is concentrated portfolios of great businesses that reward investors with rising dividends.

Starlight Global Infrastructure Fund is an opportunity to invest in large assets that provide essential services in cities throughout the world.

Additional Information

Real Assets

Starlight Global Infrastructure Fund

Inception — 2018

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Distribution Frequency

Fixed Monthly

Fund Codes / Ticker

Series A (SLC102)

Series F (SLC202)

Series FT6 (SLC252)

Series T6 (SLC152)

Series ETF (SCGI)

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Distribution Frequency

Fixed Monthly

Fund Codes / Ticker

Series A (SLC102)

Series F (SLC202)

Series FT6 (SLC252)

Series T6 (SLC152)

Series ETF (SCGI)

The views in this update are subject to change at any time based upon market or other conditions and are current as of December 10, 2025. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.