Mortgage REITs – attractive double-digit yields

Real Estate Investment Trusts (“REITs”) typically fall into two categories: 1) Equity REITs, which generally own and operate real estate (i.e. retail, industrial, office) and 2) Mortgage REITs, which generally acquire real estate-related debt. While Equity REITs typically generate rental income from leasing space to tenants, Mortgage REITs typically generate revenues from the interest earned by investing in a pool of mortgage loans.

Mortgage REITs generally provide liquidity and/or funding for both residential and commercial property owners by either purchasing or originating new mortgages. Commercial Mortgage REITs purchase commercial mortgages and commercial mortgage-backed securities (“CMBS”, pools of securitized commercial mortgages), providing liquidity and mortgage credit for property owners in the commercial real estate industry.

Mortgage REITs focused on the residential housing market purchase or originate residential mortgages and mortgage- backed securities (“MBS”, pools of securitized residential mortgages) which provides liquidity and mortgage credit for property owners in the residential real estate industry. In the U.S., residential mortgages can be further subdivided into Agency loans and Non-Agency loans.

Agency loans are created and guaranteed by one of three government-sponsored agencies: Government National Mortgage Association (“Ginnie Mae”), Federal National Mortgage (“Fannie Mae”), and Federal Home Loan Mortgage Corp. (“Freddie Mac”). Investors generally treat these agency loans as obligations of the U.S. government and so they are relatively low-yielding and very liquid. Non-agency loans are issued by financial institutions and tend to trade at higher yields since they are less liquid and carry a risk of default.

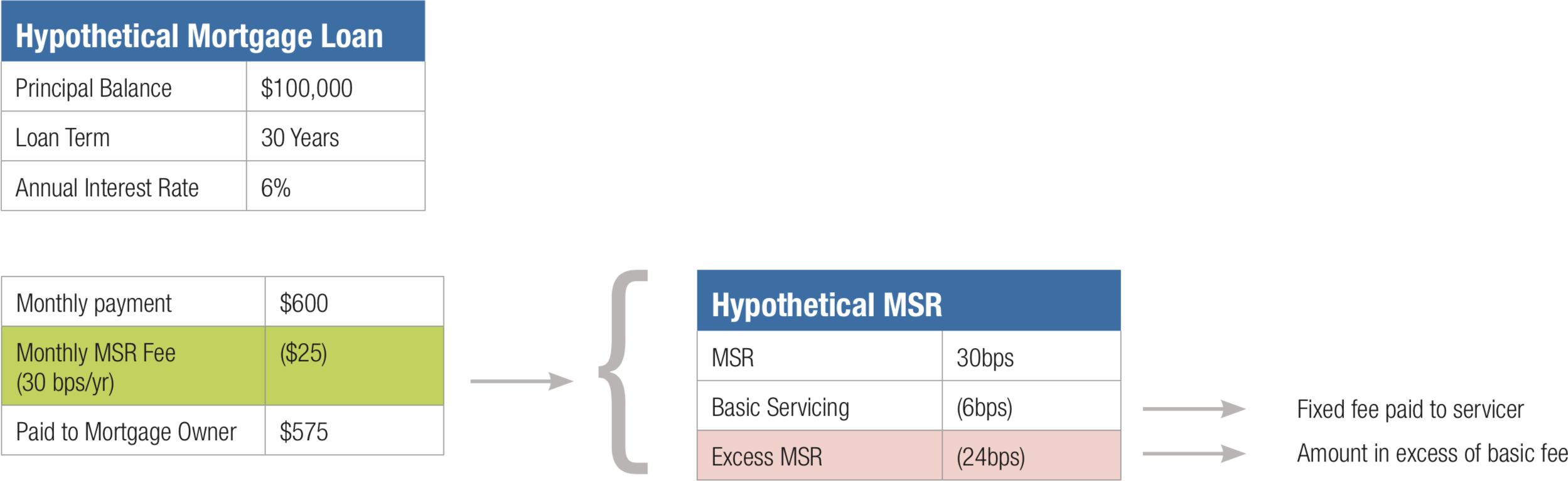

Mortgage REITs can generate revenues from servicing mortgages (collecting and distributing principal and interest payments), underwriting and/or originating mortgages and trading mortgage securities for gains. However, the largest source of revenue for Mortgage REITs is the spread they earn on their investments over their cost of capital.

A Mortgage REIT might use $1 million of equity capital and $4 million of leverage to purchase $5 million of MBS. If the MBS portfolio earns a 5% yield and the leverage has a cost of 3% then the Mortgage REIT will generate a 2% net interest margin. Leaving aside other expenses, this example would result in equity investors generating a 13% return on equity with 4x leverage. In the case of Mortgage REITs, the Return on Equity (ROE) is usually a close proxy for the ultimate dividend yield.

Mortgage REITs generally provide liquidity and/or funding for both residential and commercial property owners by either purchasing or originating new mortgages. Commercial Mortgage REITs purchase commercial mortgages and commercial mortgage-backed securities (“CMBS”, pools of securitized commercial mortgages), providing liquidity and mortgage credit for property owners in the commercial real estate industry.

Mortgage REITs focused on the residential housing market purchase or originate residential mortgages and mortgage- backed securities (“MBS”, pools of securitized residential mortgages) which provides liquidity and mortgage credit for property owners in the residential real estate industry. In the U.S., residential mortgages can be further subdivided into Agency loans and Non-Agency loans.

Agency loans are created and guaranteed by one of three government-sponsored agencies: Government National Mortgage Association (“Ginnie Mae”), Federal National Mortgage (“Fannie Mae”), and Federal Home Loan Mortgage Corp. (“Freddie Mac”). Investors generally treat these agency loans as obligations of the U.S. government and so they are relatively low-yielding and very liquid. Non-agency loans are issued by financial institutions and tend to trade at higher yields since they are less liquid and carry a risk of default.

Mortgage REITs can generate revenues from servicing mortgages (collecting and distributing principal and interest payments), underwriting and/or originating mortgages and trading mortgage securities for gains. However, the largest source of revenue for Mortgage REITs is the spread they earn on their investments over their cost of capital.

A Mortgage REIT might use $1 million of equity capital and $4 million of leverage to purchase $5 million of MBS. If the MBS portfolio earns a 5% yield and the leverage has a cost of 3% then the Mortgage REIT will generate a 2% net interest margin. Leaving aside other expenses, this example would result in equity investors generating a 13% return on equity with 4x leverage. In the case of Mortgage REITs, the Return on Equity (ROE) is usually a close proxy for the ultimate dividend yield.

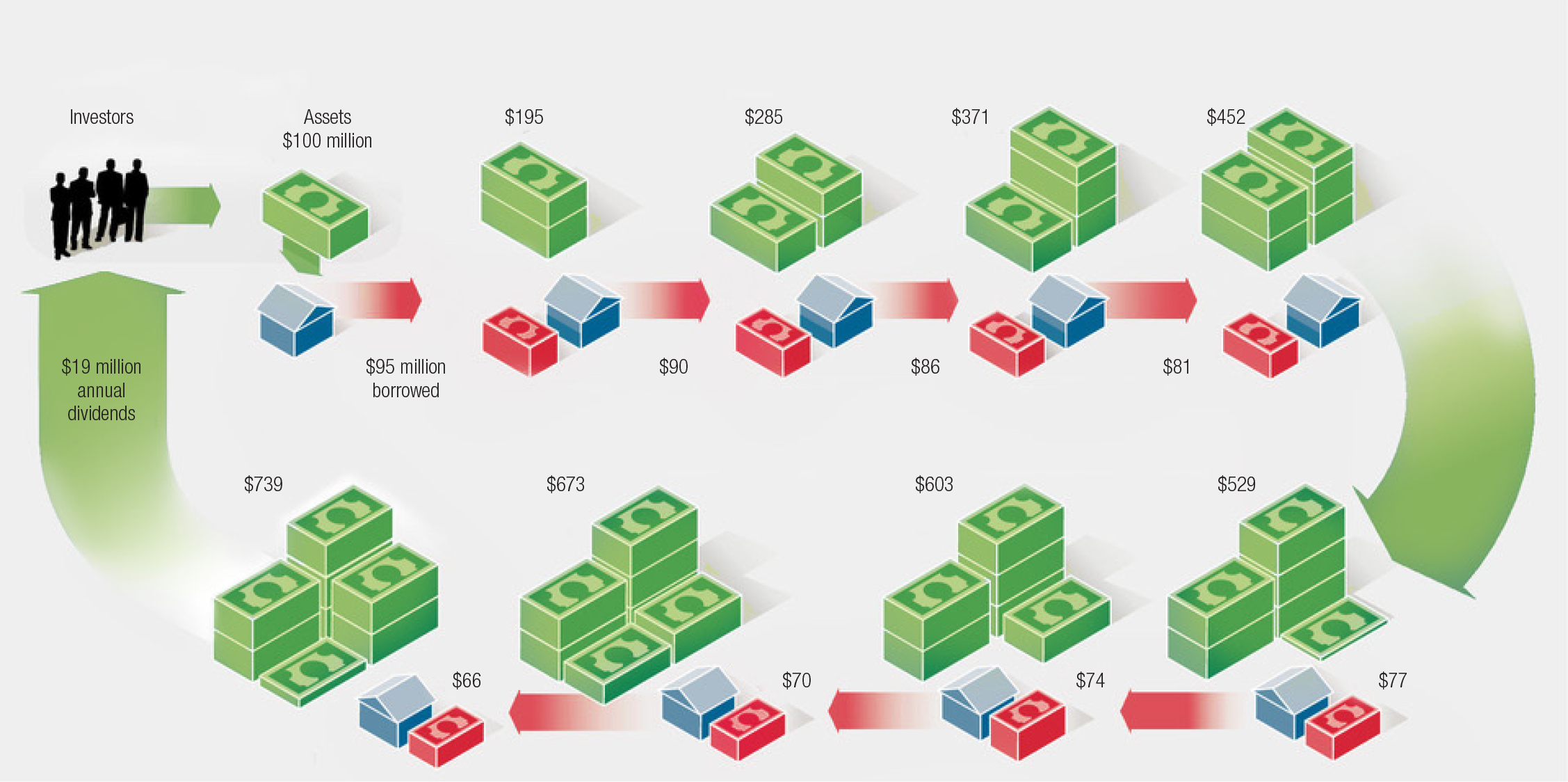

Raising the Roof: An example of how a mortgage REIT could build assets

1. The real-estate investment trust raises money in an IPO and buys mortgage-bakced securities. It then uses those securities as collateral to borrow money to buy yet more securities.

2. The REIT repeats this process, paying a small financing fee each time.

3. When the REIT reaches a leverage ratio it deems appropriate, in this case 6.4 to 1, it stops borrowing. The REIT now has a large amount of leveraged assets, from which it can pay its investors dividends.

Source: UBS; Wall Street Journal reporting

The amount of leverage and the resulting ROE the Mortgage REIT generates is largely a function of the type of securities that are being leveraged. Agency MBS is the gold standard and the lower yields these securities distribute require higher leverage to generate an attractive dividend yield. On the other end of the spectrum, CMBS generate higher yields but are usually purchased with less leverage to account for the increased credit risk. In general, Mortgage REITs earn ROEs in the 10% to 15% range with similar dividend yields.

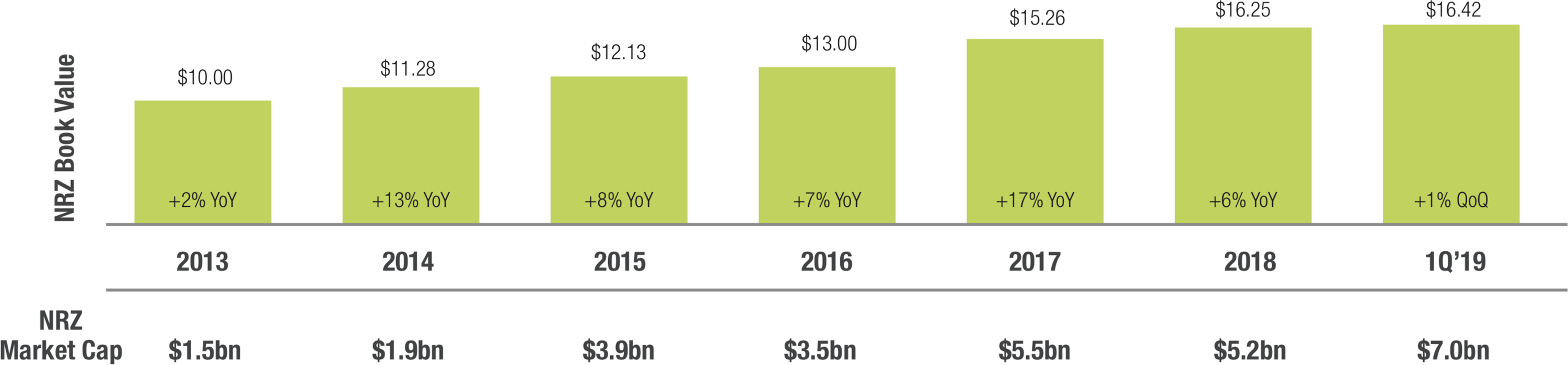

New Residential Investment Corp. (NYSE: NRZ) ("NRZ"), is a publicly traded Mortgage REIT that focuses on investments in non-agency residential MBS. NRZ generates revenue

from servicing and trading activity. Following the acquisition of Shellpoint Partners LLC in 2018, NRZ also generates revenue from a suite of ancillary businesses, including title insurance, appraisal management and real estate owned management. On June 18, 2019, NRZ announced that it had entered into an asset purchase agreement to acquire Ditech Financial LLC’s forward Fannie Mae, Ginnie Mae and non-agency Mortgage Servicing Rights (“MSR”) with an aggregate unpaid principal balance of approximately US$63 billion as of March 31, 2019. Since inception (May 2, 2013 – March 29, 2019), NRZ has generated 65% growth in book value, a 147% total shareholder return, and has paid approximately US$2.7 billion in dividends to shareholders. NRZ currently yields 12.9% (as at July 1, 2019), and has over US$33 billion in total assets. NRZ is managed by an affiliate of Fortress Investment Group LLC, a global investment management firm.

New Residential Investment Corp. (NYSE: NRZ) ("NRZ"), is a publicly traded Mortgage REIT that focuses on investments in non-agency residential MBS. NRZ generates revenue

from servicing and trading activity. Following the acquisition of Shellpoint Partners LLC in 2018, NRZ also generates revenue from a suite of ancillary businesses, including title insurance, appraisal management and real estate owned management. On June 18, 2019, NRZ announced that it had entered into an asset purchase agreement to acquire Ditech Financial LLC’s forward Fannie Mae, Ginnie Mae and non-agency Mortgage Servicing Rights (“MSR”) with an aggregate unpaid principal balance of approximately US$63 billion as of March 31, 2019. Since inception (May 2, 2013 – March 29, 2019), NRZ has generated 65% growth in book value, a 147% total shareholder return, and has paid approximately US$2.7 billion in dividends to shareholders. NRZ currently yields 12.9% (as at July 1, 2019), and has over US$33 billion in total assets. NRZ is managed by an affiliate of Fortress Investment Group LLC, a global investment management firm.

New residential has a strong track record of executing on core investment strategies, making attractive opportunistic investments and delivering consistent growth

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future perfor- mance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the port- folio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.