Fund Profile

NAV ($)

$9.485

2026/01/30

Total Net Assets ($)

$243.8 Million

2025/12/31

Distribution ($)

$0.1500 Per unit

Last paid 2025/12/31

Yield (%)

6.24% Based on NAV

2025/12/31

Management Fee2

1.25%

Investment Highlights

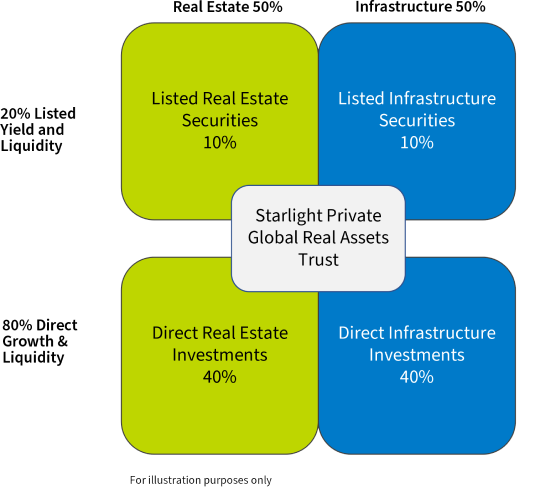

Target Allocation

Capital will be allocated across infrastructure and real estate sectors with an increased weighting given to those with the most attractive risk adjusted return potential.

Listed Real Estate & Infrastructure

- Target yield and liquidity from a global portfolio of real estate and infrastructure securities

- Historically, listed real estate and infrastructure securities have outperformed other major asset classes

- Access to real estate and infrastructure sectors that are not available in the listed Canadian market

Private Real Estate & Infrastructure

- Potential growth from a portfolio of private infrastructure and real estate fund and investments

- Unlisted, real estate and infrastructure solutions provide uncorrelated returns with lower volatility

- Exclusive access to institutional global private real estate solutions managed by best in class asset management teams

Trust Objectives

The Trust's investment objectives are to provide unitholders with cash distributions and long-term capital appreciation through exposure to institutional quality real assets in the global real estate and global infrastructure sectors, and to a lesser extent, the global diversified equity sector.

Trust Facts

Fund Code

SLC1403

Currency

CAD

Distribution Frequency

Distribution

Investment Type

Structured Products

Registered Investment Eligible

Yes

Total Number of Holdings

45

Investment Management Team

Dennis Mitchell MBA, CFA, CBV

Chief Executive Officer and Chief Investment Officer

Fund Tenure

2018-12-13

Read Bio >

Executive Team

Dennis Mitchell MBA, CFA, CBV

Chief Executive Officer and Chief Investment Officer

Graeme Llewellyn CPA, CA

Chief Financial Officer and Chief Operating Officer

Board of Trustees and Audit Committee

Denim Smith

Lead Trustee, Chairman of the Audit Committee

Dennis Mitchell-old MBA, CFA, CBV

Chairman of the Board

Graeme Llewellyn CPA, CA

Trustee

Jasmin Jabri

Trustee

Gajan Kulasingam CFA, CPA, CA

Trustee, Audit Committee Member

Mandy Abramsohn CPA, CA, CFA, CBV

Trustee, Audit Committee Member

Sandra Levy LL.B, B.A. (Hons)

Trustee

Related Documents

Offering Memorandum

*Where this is a new fund, the risk rating is only an estimate by Starlight Capital. Generally, we determine the risk rating for each fund in accordance with a standardized risk classification methodology in NI 81-102 that is based on the fund’s historical volatility as measured by the 10-year standard deviation of the returns of the fund. Standard deviation is a common statistic used to measure the volatility and risk of an investment. Funds with higher standard deviations are generally classified as being more risky. Just as historical performance may not be indicative of future returns, a fund’s historical volatility may not be indicative of its future volatility. You should be aware that other types of risk, both measurable and non-measurable, also exist.

1Redemption transactions are currently suspended and will remain so until the special redemption right is offered following the closing of the Trust’s public offering of Preferred Units. For full details, please refer to the Management Information Circular dated June 13, 2025.

2Net of accrued management fees and all fund expenses.

Starlight Investments Capital LP (“Starlight Capital”) is the investment manager of the Global Real Assets Trust. Structured Products are offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement.

Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investment funds. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the offering memorandum before investing. Investors should consult with their advisors prior to investing. The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavor to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Starlight Capital mutual funds, exchange traded funds, offering memorandum funds and structured products are managed by Starlight Capital, a wholly-owned subsidiary of Starlight Investments. Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Are you an accredited investor?

Starlight Private Pools are offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement. By clicking “Accept”, you confirm that you are an “accredited investor” within the meaning of National Instrument 45-106 – Prospectus Exemptions, and in Ontario, within the meaning of Section 73.3 of the Securities Act (Ontario) as supplemented by the definition in National Instrument 45-106, on the basis that you fit within the category of an “accredited investor” as defined therein.

You may be an “accredited investor” if:

- your net income before taxes exceeded $200,000 in both of the last two years and you expect to maintain at least the same level of income this year; OR Your net income before taxes, combined with that of a spouse, exceeded $300,000 in both of the last two years and you expect to maintain at least the same level of income this year;

- you, alone or together with a spouse, own financial assets worth more than $1 million before taxes but net of related liabilities (cash, or certain investments such as public equity or bonds, would be considered liquid/financial assets); or

- you, alone or together with a spouse, have net assets of at least $5 million (for the purposes of the net asset test, the calculation of total assets would include the value of a purchaser’s personal residence and the calculation of total liabilities would include the amount of any liability (such as a mortgage) in respect of the purchaser’s personal residence).

It is your obligation to consult with your financial advisor and/or such other advisors as you deem necessary in making the determination that you meet the definition of “accredited investor”.

Disclaimer

Information pertaining to the Starlight Private Pools is not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of the Starlight Private Pools are made pursuant to their respective offering memorandum only to those investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. Important information about the Starlight Private Pools including a statement of each fund’s fundamental investment objective, is contained in their respective offering memorandum, a copy of which may be obtained from your dealer. Read the applicable offering memorandum carefully before investing. Unit values and investment returns will fluctuate.

Are you an accredited investor?

Unison Acquision Trust is offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement. By clicking “Accept”, you confirm that you are an “accredited investor” within the meaning of National Instrument 45-106 – Prospectus Exemptions, and in Ontario, within the meaning of Section 73.3 of the Securities Act (Ontario) as supplemented by the definition in National Instrument 45-106, on the basis that you fit within the category of an “accredited investor” as defined therein.

You may be an “accredited investor” if:

- your net income before taxes exceeded $200,000 in both of the last two years and you expect to maintain at least the same level of income this year; OR Your net income before taxes, combined with that of a spouse, exceeded $300,000 in both of the last two years and you expect to maintain at least the same level of income this year;

- you, alone or together with a spouse, own financial assets worth more than $1 million before taxes but net of related liabilities (cash, or certain investments such as public equity or bonds, would be considered liquid/financial assets); or

- you, alone or together with a spouse, have net assets of at least $5 million (for the purposes of the net asset test, the calculation of total assets would include the value of a purchaser’s personal residence and the calculation of total liabilities would include the amount of any liability (such as a mortgage) in respect of the purchaser’s personal residence).

It is your obligation to consult with your financial advisor and/or such other advisors as you deem necessary in making the determination that you meet the definition of “accredited investor”.

Disclaimer

Information pertaining to the Unison Acquision Trust is not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of the Unison Acquisition Trust are made pursuant to their respective offering memorandum only to those investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. Important information about the Unison Acquisition Trust including a statement of each fund’s fundamental investment objective, is contained in their respective offering memorandum, a copy of which may be obtained from your dealer. Read the applicable offering memorandum carefully before investing. Unit values and investment returns will fluctuate.

Are you an accredited investor?

Tower Development Trust is offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement. By clicking “Accept”, you confirm that you are an “accredited investor” within the meaning of National Instrument 45-106 – Prospectus Exemptions, and in Ontario, within the meaning of Section 73.3 of the Securities Act (Ontario) as supplemented by the definition in National Instrument 45-106, on the basis that you fit within the category of an “accredited investor” as defined therein.

You may be an “accredited investor” if:

- your net income before taxes exceeded $200,000 in both of the last two years and you expect to maintain at least the same level of income this year; OR Your net income before taxes, combined with that of a spouse, exceeded $300,000 in both of the last two years and you expect to maintain at least the same level of income this year;

- you, alone or together with a spouse, own financial assets worth more than $1 million before taxes but net of related liabilities (cash, or certain investments such as public equity or bonds, would be considered liquid/financial assets); or

- you, alone or together with a spouse, have net assets of at least $5 million (for the purposes of the net asset test, the calculation of total assets would include the value of a purchaser’s personal residence and the calculation of total liabilities would include the amount of any liability (such as a mortgage) in respect of the purchaser’s personal residence).

It is your obligation to consult with your financial advisor and/or such other advisors as you deem necessary in making the determination that you meet the definition of “accredited investor”.

Disclaimer

Information pertaining to the Tower Development Trust is not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of the Tower Development Trust are made pursuant to their respective offering memorandum only to those investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. Important information about the Tower Development Trust including a statement of each fund’s fundamental investment objective, is contained in their respective offering memorandum, a copy of which may be obtained from your dealer. Read the applicable offering memorandum carefully before investing. Unit values and investment returns will fluctuate.